Newsletter 12/11: Charlotte hospitals say ‘no thanks’ to charity’s efforts to erase medical debt

Plus: New wine bar inside Belk at SouthPark Mall; Pineville and Fort Mill residents object to electric substation; Triggerman in Carruth case dies in prison; France wowed by Krispy Kreme donuts

Today’s Charlotte Ledger is sponsored by T.R. Lawing Realty:

A charity wants to buy patients’ uncollected debt and forgive it, but Atrium and Novant won’t sell; a retired Atrium physician is on a quest to change that

Retired Atrium Health physician Chris Lakin wants both hospitals in Charlotte to consider working with a charity that buys medical debt and forgives it. But they say they already offer financial help to patients. (Photo by Michelle Crouch of Charlotte Ledger/N.C. Health News)

By Michelle Crouch

Earlier this year, Trinity Moravian Church in Winston-Salem received national attention for doing something extraordinary: It erased nearly $3.3 million in medical debt for 3,355 local families living below the poverty line.

The tiny church, with an average attendance of about 75 on Sundays, did it by raising $15,000 and partnering with RIP Medical Debt, a national nonprofit that buys unpaid medical debt and forgives it.

RIP Medical Debt has wiped out billions of dollars in medical debt across the country in less than a decade. Recent campaigns in North Carolina have benefited residents in Davidson, Forsyth, Durham, Orange and Wake counties.

But when retired Atrium Health physician Chris Lakin contacted RIP to see about launching a campaign to forgive debt for Charlotte residents, the charity said it wasn’t possible.

Why? Because RIP has been unable to purchase enough qualifying medical debt in Mecklenburg County, RIP spokesman Daniel Lempert said.

The problem is not a lack of medical debt in Charlotte. Rather, the issue is that Atrium Health and Novant Health — the area’s two big hospital systems — haven’t been willing to sell or donate their uncollected debt to RIP.

“If we can’t get our hands on it, we can’t abolish it,” Lempert said.

With health care costs escalating, nearly seven in 10 U.S. adults have received a medical bill they could not afford, according to an August 2023 poll commissioned by RIP, along with the American Cancer Society and the Leukemia and Lymphoma Society. The poll also found that about half of U.S. adults don’t realize that health care providers offer financial assistance.

Medical debt is an especially acute problem in Mecklenburg County, where 18% of families have medical debt in collections, compared to a national average of 13%, according to data compiled by the Urban Institute.

Nationally, two-thirds of bankruptcies cite medical debt as a cause.

Atrium’s and Novant’s unwillingness to work with RIP baffles Lakin, who sees an opportunity to change people’s lives in a significant way, with some positive public relations for the hospitals.

“Here is a chance to do some good,” Lakin said. “I believe it would be a win-win for the hospital, and they wouldn’t even have a conversation with RIP.”

The hospitals said they already have charity policies and financial assistance programs to serve patients. Atrium also said that the community would be better served by directing one-time funds toward other programs, and that working with RIP could undermine efforts to get people to sign up for Medicaid. [edited 12/11/23 at 1:30pm to clarify hospitals’ positions]

The RIP model

RIP Medical Debt was founded in 2014 by two former debt collectors who saw a new way to help those in need. Their idea was simple: Buy up large bundles of delinquent medical debt, which gets sold at pennies on the dollar — the same way third-party debt collectors do. But instead of aggressively pursuing patients for payment, they send patients a letter telling them that their debt has been forgiven.

The nonprofit abolishes debt for individuals who earn less than 400% of the federal poverty level — about $120,000 for a family of four — or whose debts exceed 5% or more of their annual income.

On average, a $1 donation to RIP erases about $100 in debt, the charity said.

Most RIP campaigns have been launched by charitable organizations that want to help people in their communities who are under financial stress. But governments have also gotten involved. Local officials in Cook County, Ill. (which includes Chicago), and Toledo, Ohio, used federal Covid relief funding to erase millions in medical debt in their communities.

More recently, New York City cancer patient Casey McIntyre made international news after she set up an RIP Medical Debt fund to cancel others’ medical debt as a parting gift after her death on Nov. 12, 2023. So far, her campaign has raised more than $800,000 and canceled more than $60 million in debt nationwide.

Hospitals: We already have charity policies

Lempert said a Charlotte church ran an RIP campaign in 2019, before the charity could buy directly from hospitals, that erased the Charlotte debt that was available on the secondary market. To make a bigger dent, RIP would need the hospitals — which dominate the local health care market — to release more, he said.

In emailed responses to questions from The Ledger/N.C. Health News, Novant and Atrium both said they already have generous financial assistance and charity care policies that serve patients.

“We work alongside our patients to manage the cost of care, including providing care at no cost to our uninsured patients with a household income of up to 300 percent of the federal poverty level through our robust financial assistance policy,” the Novant statement response read. “This policy covers about 90 percent of all uninsured patients. The remaining 10 percent of uninsured patients receive individualized support, including significant discounts and interest-free payment plans for those who need the option of paying their balance over time.”

Atrium Health said it offers “robust, equitable and long-term support to patients of all income levels” and proactively helps patients enroll in Medicaid or other health insurance options.

“We believe our policies and practices afford patients and our communities a better long-term and ongoing solution to addressing and preventing medical debt,” the hospital added.

Atrium also said the community would be better served by directing one-time funds toward other needs, such as public health initiatives that focus on improving health in the region. (Read Atrium’s answers to our questions and full statement.)

Marcus Kimbrough, who handles government affairs and community engagement for Atrium in the greater Charlotte area, sent a similar response via email to Lakin.

“RIP’s proposal is well-intended but conflicts with our charity care policy (which is thoughtfully crafted to be consistent, fair and equitable) and may undermine efforts to promote enrollment in insurance coverage, which is particularly important right now due to Medicaid redeterminations,” the email said.

Both Atrium and Novant noted in their responses to The Ledger/N.C. Health News that they don’t sell bad debt to debt buyers. (Hospitals that don’t sell their debt often contract with a secondary collection agency that tries to collect bad debt on their behalf. That appears to be Atrium’s practice, according to its billing and collections policy.)

RIP: Program would supplement, not conflict

In response to the hospitals’ concerns, RIP said its program would supplement their financial assistance programs, not conflict with it.

While Atrium and Novant give free care to uninsured families who meet their requirements and earn up to 300% of the federal poverty level, RIP assists families who earn up to 400%. In addition, RIP said, some patients don’t know that hospitals offer assistance, may be too proud to apply or may assume they aren’t eligible because they have insurance.

“Hospitals don’t find everyone who qualifies for financial assistance, and working with RIP Medical Debt is like a safety net for accounts that weren’t found, or perhaps didn’t qualify because of geography or other limitations in the existing policy,” said Ruth Lande, RIP’s vice president for hospital relations.

RIP can then give hospitals valuable, confidential data on the income level and circumstances of patients with bad debt, she added, allowing them to consider changes to their financial assistance policies to catch those patients.

Lande noted that RIP works with other hospitals that don’t sell bad debt. She said RIP offers an “industry-competitive” rate for debt that is intended to be financially appealing to hospitals, even if they don’t normally sell their debt.

“Most of these accounts are not collectible. It’s mostly people who are unable to pay, so it is a good deal (for hospitals),” she said.

If the hospitals work with RIP, it should not dissuade people from enrolling in Medicaid or insurance on the Affordable Care Act insurance exchange, Landes said, because RIP provides help long after patients have made decisions about purchasing insurance.

“We would be canceling older debts for lower-income individuals, and the letter (to those patients) clearly states this is a one-time gift funded by the local community,” Lande wrote in an email. “Why would a person who gets that letter decide to cancel their insurance or not sign onto insurance?”

She said many patients helped by RIP already have insurance but can’t afford out-of-pocket expenses.

A 2022 study by a consulting firm found that the majority of hospital bad debt, 57%, is for patients who have insurance — a five-fold increase from 2018. The study attributed the change to the increasing prevalence of high-deductible plans and other insurance options that push more costs onto patients.

A growing number of hospitals work with RIP

Initially, RIP bought debt only from secondary providers such as debt collectors and debt buyers. However, the nonprofit started buying directly from hospitals in 2020 after a federal ruling clarified that the practice was allowed.

Since then, RIP has increasingly sourced its debt directly from health systems, Lempert said.

“We have a very dedicated hospital relations team doing a lot of work to explain our model to the revenue cycle folks at hospitals,” he said. “A fair amount of education has to happen. Every day, we are bringing more into the fold.”

Some hospitals — such as Georgia-based St. Mary’s Health Care System, Connecticut-based Trinity Health and Tennessee-based Ballad Health — have capitalized on the public relations value of their work with RIP and issued news releases about it.

“Everyone who will receive their debt abolished through this collaboration with RIP Medical Debt qualifies for our charity care policy, but for various reasons, they did not take advantage of it in prior years, or their circumstances have changed, leaving many without assistance,” Ballad Health executive Anthony Keck said in a 2021 news release. “By removing this burden of old debt, we hope to better engage with our patients, so they access care and other services when they need them without the fear of unmanageable expenses.”

Retired physician hits roadblocks

Lakin, a pediatrician who retired from Atrium in 2018, said he’s still trying to get his former employer to reconsider and work with RIP Medical. He sent RIP’s responses to Kimbrough, who he said didn’t respond despite a follow-up. He also emailed an Atrium physician executive about the program; she responded by emphasizing the hospital’s charity care program.

Then, Lakin looked for a way to get in front of the board of the Charlotte-Mecklenburg Hospital Authority, the public entity that does business as Atrium Health.

However, a spokesman said the board does not allow public comment and did not offer an alternative way to contact the board, according to Lakin. An email Lakin sent to a physician on the board went unanswered.

Lakin then contacted several Mecklenburg County commissioners. He said he thought they might have some influence over Atrium, since it is a public hospital authority.

Mecklenburg County Board of Commissioners Chair George Dunlap, who approves appointments to the hospital authority board, said that despite Atrium’s public charter, the county can’t tell the hospital what to do.

“The decision to sell medical debt is solely the decision of the board of directors of Atrium,” he said. “We don’t have any say. We can't force the hospital to sell it. That’s not our role.”

County Commissioner Laura Meier told The Ledger/N.C. Health News that she doesn’t understand why Atrium is opposed to working with RIP Medical, but beyond connecting Lakin to a contact at Atrium, she didn’t know how the county could help.

“I told Dr. Lakin, ‘The county just doesn’t have influence over the hospitals,’” she said.

Michelle Crouch covers health care. Reach her at mcrouch@northcarolinahealthnews.org.

This article is part of a partnership between The Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. We make these articles available free to all. For more information, or to support this effort with a tax-free gift, click here.

Today’s supporting sponsor is Crisis Assistance Ministry. Today at Crisis Assistance Ministry, 100 families will seek to avoid eviction or utility loss. You can ensure those neighbors maintain the hope, warmth and light of home this season.

New at SouthPark Mall: a wine bar inside a department store

Arthur’s Wine Bar opened Dec. 2 near the interior entrance to Belk that faces Neiman Marcus.

The Belk at SouthPark Mall has a new addition, located between the perfume section and racks of Izod shirts: a stylish wine bar, operated by the longtime Charlotte restaurant Arthur’s.

A bartender at Arthur’s Wine Bar said it opened on Dec. 2. It has not been publicly announced, and Arthur’s — which also operates a restaurant and a wine shop on the bottom floor of Belk — has not mentioned the new wine bar on its social media accounts.

Arthur’s did not reply to multiple inquiries from The Ledger late last week.

Adding a wine bar inside of a department store is part of a trend known as “experiential retail,” in which stores and malls become not just places to shop, but are also about making memories with friends and living your best life, with things to do and interactive experiences. It follows, for instance, newer and remodeled Harris Teeter stores, which have added bars with local beers on tap.

Arthur’s, founded in 1972, is one of Charlotte’s oldest restaurants. In its early years, it sold sandwiches at the old Ivey’s department store uptown, before relocating to Belk at SouthPark in 1991.

The new wine bar is located on the main floor of Belk, near the interior entrance that faces Neiman Marcus. It has a bar with about a dozen seats as well as a few small tables and a casual seating area with couches. There were three customers at the bar when The Ledger visited Thursday around lunchtime, including one drinking a glass of red who exclaimed that he was excited the wine bar was open.

The menu lists about 12 wines, with glasses from $8 to $15 and bottles between $22 and $99. Food options consist of charcuterie board ($15), “Hubbs Happy Hour Mix” ($7) and assorted chocolates and pastries ($10). It also serves beer. —Staff writer Lindsey Banks contributed to this article.

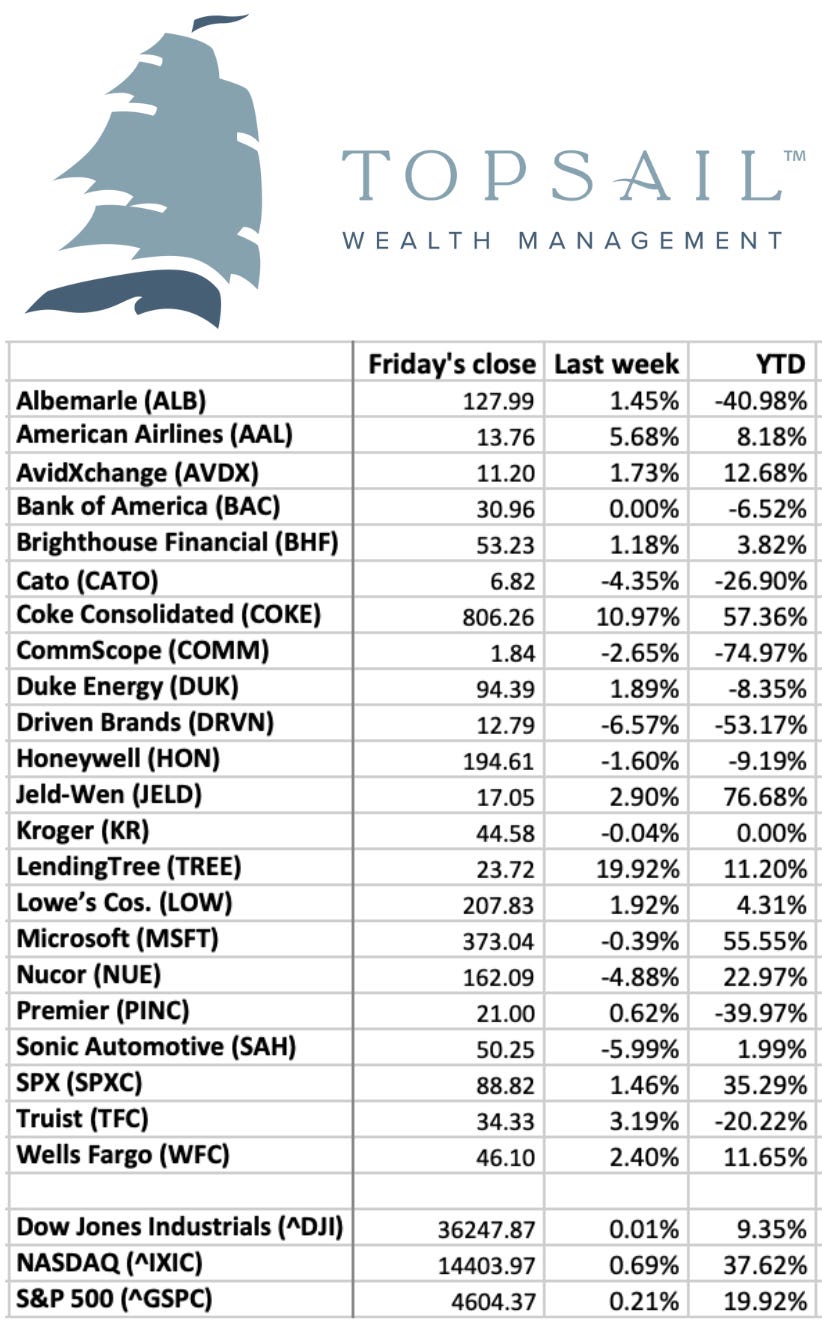

Taking Stock, sponsored by Topsail Wealth Management

Topsail Wealth Management partners with you to provide personalized advice. Minimizing costs and the complexities of your wealth and investing plan.

How local stocks of note fared last week (through Friday’s close), and year to date:

Neighbors upset over plans to build an electric substation in Pineville

Residents of a neighborhood that straddles the Pineville-Fort Mill border are protesting plans to build a new electric substation in Pineville, saying the substation will harm their health and property values and threaten their community’s character.

The proposed location is a 1.01-acre site in Pineville off N.C. 51 near the Miller Flea Market and McCullough neighborhood. The Pineville Town Council plans to purchase the property and would construct the substation with Electricities, a Huntersville-based electric utility company.

Nearby residents posted an online petition last week asking the town of Pineville to build the substation elsewhere. The Pineville Town Council will ultimately decide on the substation’s location. As of Sunday, nearly 900 people had signed the petition.

The residents’ petition argues that the project infringes on local landmarks like the nearby Miller Flea Market, and says they fear the substation will impact their health because of electromagnetic field exposure. The town and Electricities say the substation is needed as the demand for electricity grows and that residents’ health will not be affected. —LB

The Ledger first reported a fuller version of this story on our website on Thursday. You can check it out here: [keep reading]

Quotable: Ooh-la-la! A warm reception for Krispy Kreme in France

From Thursday’s New York Times article “Hot Glazed Doughnuts on the Menu, and Parisians Can’t Get Enough,” about the opening of France’s first Krispy Kreme. The chain is based in Charlotte:

As dawn broke in central Paris on Wednesday, a throng of 500 people, mostly French, stood with uncharacteristic patience in a snaking line, intent on buying a decidedly un-French confection: an American doughnut. A hot, glazed Krispy Kreme doughnut, to be exact.

It was the grand opening of the chain in France, and patrons — dozens of whom had camped out overnight — watched through a giant window as a conveyor belt ferried fried dough toward a waterfall of sugary frosting. When the doors opened, they swarmed inside, ordering doughnuts by the dozen to take out, or noshing at bistro tables in a cafe-style setting. …

The sight of French people flocking to American fare might have seemed surreal a generation ago in a country that loves its Michelin-starred restaurants, three-hour dinners and iconic baguette. But today, the world’s gastronomic capital happens to be one of the biggest markets in Europe for major American fast-food chains …

Doughnuts rolled off an assembly line that had been imported from North Carolina, where the chain is based. New flavors were created to appeal to the French palate, including a fresher fruit taste for the apple doughnut and less sweetness to the strawberry frosting.

You might be interested in these Charlotte events

Events submitted by readers to The Ledger’s events board:

THURSDAY: Sustain Charlotte's 704 Impact Academy - Session 3, 6-8 p.m., Charlotte Art League. Impact 704 Academy, is Sustain Charlotte’s advocacy-focused series about sustainable land use and transportation. Attend one, two, or all three sessions and meet others who share your desire to make an impact! This no-cost event is supported by Southminster. Light refreshments will be provided. This is an alcohol-free event. While we won’t have childcare available, you’re welcome to bring your kids and supervise them. Free.

➡️ List your event on the Ledger events board.

In brief:

Convicted triggerman in Carruth case dies in prison: Van Brett Watkins, the associate of former Carolina Panthers player Rae Carruth who was convicted of shooting and killing Carruth’s girlfriend in 1999, has died in prison of natural causes at age 63, WCNC reported. Watkins had pleaded guilty to killing Cherica Adams on Rea Road in south Charlotte and was serving a 40-year prison sentence. The Ledger’s Lindsey Banks examined Watkins’ case in April.

Homelessness up: The number of people experiencing homelessness in Mecklenburg County grew by 11% in the last year, to about 2,700 people, according to a new county report. In addition, evictions are up, and half of renters are spending 30% or more of their income on housing, the report found.

No steeplechase: The Queen’s Cup Steeplechase will not take place in 2024, as the event’s founders have been working to transition leadership of the annual Union County event to new operators. (Biz Journal, subscriber-only)

Interest in running sports gambling: Eleven sports-betting operators have requested applications to offer sports gambling in North Carolina when it becomes legal next year, in addition to 24 suppliers and eight service providers. To be approved, operators need to have a deal in place with a sports team and pass background checks. The application deadline is Dec. 27. Sports wagering is scheduled to start by June 2024. (BetCarolina)

On the city agenda: The Charlotte City Council is scheduled to hear updates on city infrastructure and the Eastland Yards development on Monday. Council members are also expected to view body cam footage in closed session of a controversial arrest last month in which a police officer was filmed striking a woman who police said had hit an officer in the face and was resisting arrest. The videos are expected to be released publicly on Tuesday.

Charlottean to lead big foundation as board chair: Charlotte banker Ralph Strayhorn, CEO of New Republic Partners, was elected chair of the Golden Leaf Foundation’s board. The Rocky Mount-based foundation oversees a $1.2B investment fund. (Business NC)

Need to sign up for this e-newsletter? We offer a free version, as well as paid memberships for full access to all 4 of our local newsletters:

The Charlotte Ledger is a locally owned media company that delivers smart and essential news through e-newsletters and on a website. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

Like what we are doing? Feel free to forward this along and to tell a friend.

Executive editor: Tony Mecia; Managing editor: Cristina Bolling; Staff writer: Lindsey Banks; Business manager: Brie Chrisman, BC Creative