I minted an NFT — and can explain what that means

Plus: Former Miss USA Cheslie Kryst dies at age 30; Pharma giant heading to Concord; Manager of stinky plant says 'we let the community down'; AvidXchange stock keeps falling

Good morning! Today is Monday, January 31, 2022. You’re reading The Charlotte Ledger, an e-newsletter with local business-y news and insights for Charlotte, N.C.

Need to subscribe — or upgrade your Ledger e-newsletter subscription? Details here.

Today’s Charlotte Ledger is sponsored by SPARK Publications. SPARK Publications publishes nonfiction books that help your business grow. Thinking about writing a book? “Ask Fabi” is a free virtual Q&A held on February 10, at 6:00 pm (EST). Register here!

Whether they’re a fad or the future, NFTs are growing in popularity in Charlotte; How we created ‘The Exclusive Charlotte Ledger NFT Collection’

by Tony Mecia

OK, physical world, we’re ready for our virtual-world riches to start rolling in.

We’ve been reading lately about the big money to be made in non-fungible tokens, or NFTs — a digital piece of art sold for $69M last year at Christie’s, for instance — and now The Charlotte Ledger is ready to get its piece of the action.

We minted some Ledger NFTs, listed them on OpenSea by paying in ethereum, and now are auctioning them off using blockchain technology in the metaverse. If you have no idea what that sentence means, it’s OK — I, too, had only a vague understanding of this hot tech topic until a couple weeks ago. Today, though, I have a less vague understanding, and over the weekend, I put some Ledger NFTs up for auction — which means (in theory) that I could be on the cusp of becoming a multimillionaire. It all depends on how the market responds. Fingers crossed!

Lately, talk of NFTs has appeared all over the place, even in Charlotte:

In December, Bojangles auctioned off seven NFTs of artwork depicting Chicken Supremes. They each sold for between $700 and $1,600, Charlotte Inno reported this month.

In May, the Charlotte Hornets offered fans the chance to buy NFTs of artwork commemorating the team’s inaugural season for $4.99 apiece — becoming one of the first pro sports teams to use the technology.

This month, Protagonist Beer auctioned off an NFT, with the high bidder earning the right to help the brewery create a beer and choose the beer’s name. It sold for nearly $2,500, according to WBTV.

“We’re just at the surface,” says Bobby Robinson, a technology founder and intellectual property lawyer at Nexsen Pruet in Charlotte who is known as “The Influencer Attorney.” “Most of the bigger cities — Miami, New York, Austin, Los Angeles — are at the forefront of it. But you do have other markets like Charlotte that are trying to ramp up. It’s a really exciting time to be in this space here in Charlotte.”

Robinson has linked up with a new group called NFT CLT, which holds seminars to educate local businesses about NFTs.

So what the heck are NFTs, anyway?

So are they the future, or just a fad? Who knows. But some people are making money on them, and the buzz on NFTs is increasing — yet most people have no idea what they are. The Ledger decided to find out and make our own NFTs as an educational and journalistic exercise. (Of course, if you’d like to drop hundreds, thousands or millions of dollars on some hastily assembled digital files from someone with no artistic or creative background, we’re not going to stop you.)

To guide us in our quest to understand and create NFTs, we turned to friend of The Ledger John Short. John wrote our “Historical Heavyweights” series last fall, and he’s also co-host of The Charlotte Podcast. His day job is in finance and involves cryptocurrencies, and he dabbles in NFTs on the side for fun, mostly — though he happened to buy a pack of NBA digital avatars last year, and some turned out to be worth a couple thousand dollars. Lately, he’s been buying digital racehorse NFTs, which owners can breed and race online.

“I started off with house money and have been able to keep digging a little bit,” he said. “I think it’s funny and kind of stupid, and I like knowing about it.”

Short explains that the best way to describe NFTs is to think of them as digital trading cards. You can buy and sell them. There are limited quantities. And a marketplace decides what they are worth, which in some cases bears no relationship to what they cost to produce.

Think about it: Trading cards cost almost nothing to make. So why does a 1968 card of Nolan Ryan sell for $612,000, while a 1978 card of Johnnie LeMaster is available for 99 cents? It’s because quantities are limited, and a lot of people want to own a rare card of a Hall of Fame pitcher (Ryan), while almost nobody wants the card of an undistinguished and obscure shortstop (LeMaster). The same is true of other luxury goods, like art, fine wine and diamonds — they’re rare and in high demand.

The term “non-fungible” — clearly devised by engineers and tech geeks, not marketers — means that NFTs cannot be replicated. They have individual identities. There is a verifiable record of their creation and ownership on the blockchain, which is a decentralized record of transactions. Unlike a bank, the blockchain is under nobody’s control — it’s just an agreed-upon set of standards.

There are plenty of things, though, that are one-of-a-kind but that have no value because there’s no demand for them, like a toddler’s artwork. You wouldn’t think a collection of 107 computer-generated cartoon images of bored apes would be worth anything, either, but they sold at Sotheby’s auction house in September for $24.4M.

So it’s really whatever people are willing to pay. Or, as Short puts it: “Rich people pay for dumb (stuff) all the time.”

The more interesting use of NFTs, he says, is when they are tied to other things that have established real-world value, like, for instance, memberships to gyms or clubs. NFTs could also become more relevant in the next few years, with some tech futurists predicting much richer and all-consuming digital experiences in an environment that has been dubbed the “metaverse.” (That’s why Facebook changed the name of its parent company to “Meta.”)

It is not always apparent where new technologies are heading, and many people seem to be getting into NFTs and cryptocurrencies to be ready for whatever comes next.

Creating sure-to-be-hot Ledger NFTs

And that leads us to our foray into creating “The Exclusive Charlotte Ledger NFT Collection.”

Short walked me through what he said was a simple way to create an NFT, a process known as “minting.” The quick version: Create a digital wallet, buy a cryptocurrency called ethereum, upload a few digital files and mint the NFT by uploading it to an auction site and paying a fee, known as “gas.” My response was something like: “Say what now?”

Here’s the longer version of what I did:

Create digital files. NFTs are typically images, videos or sound files, in familiar formats like .JPG, .PNG or .MP4. I thought about what Charlotte Ledger items might sell in the metaverse and settled on four: avatars of me and of managing editor Cristina Bolling, the Ledger logo with a swirly background and an autographed first page of the first-ever Charlotte Ledger from February 2019. I did basic graphic design on a website called Canva and created the avatars on a website called readyplayer.me, which converted head-shot photos into 3D characters that might only vaguely resemble us but at least appear flattering.

Open a virtual wallet. Short directed me to a site called MetaMask, which allows you to download a Chrome browser extension and buy ethereum using a credit card via an exchange company called Wyre. I bought $175USD worth, or roughly 0.065ETH, to cover fees I would encounter later.

Connect wallet to auction/minting site. Next, I went to a website called OpenSea, which bills itself as “the NFT marketplace with everything for everyone — including those who don’t know what NFTs are.” Perfect. I entered my MetaMask account number and created a profile.

Upload images and pay “gas.” I uploaded the image files, making sure to provide a brief and sales-y description, using terms like “exclusive,” “unique” and “vintage.” And then I paid the one-time fees, a total of $136.14 in my case, though the amount can fluctuate. (I later paid an additional $13.78 because I messed up the sales terms on my avatar and had to correct them.) I set the minimum bid price at $1 each — what a deal!

The whole process took me about 90 minutes, and I found it surprisingly straightforward. I should mention that I’m a Gen X-er who is comfortable with computers but not especially tech-savvy.

Excited about my achievement with the blockchain and crypto and NFTs, I rushed to tell my wife. The conversation went something like this:

Me: “I just minted some NFTs!”

Her (repeating back slowly): “You … just … minted … some … NFTs.”

Me: “Yeah, you create a digital file, then auction it off on the ‘metaverse,’ and people can buy it.”

Her: “Oh, like Facebook Marketplace.”

Me: “Yeah, except it’s all-digital. There is no physical object being traded.”

Her: “Why would somebody buy that?”

OK, that’s a fair question. Maybe because they see value in it? They want to get in on the ground floor of something big? Or instead of asking why somebody would buy Ledger NFTs, maybe we should be asking, “Why wouldn’t they?”

We’ll find out soon enough. It has been nearly two days since I listed “The Exclusive Charlotte Ledger NFT Collection” on OpenSea, and so far there have been no bids.

Assuming I’m not sipping a margarita on a Caribbean beach next week, I’ll let you know how this auction pans out. The deadline is Saturday at 9 a.m.

Today’s supporting sponsors are T.R. Lawing Realty…

… and Whitehead Manor Conference Center, a peaceful, private, and stress-free space for your organization’s next off-site meeting or event. Conveniently located in South Charlotte, Whitehead Manor is locally owned and operated and provides modern meeting capabilities with attention to stellar service!

In brief:

Tragic death: Cheslie Kryst, a former Charlotte attorney who went on to become Miss USA and an “Extra” TV personality, died Sunday morning at age 30. Reports in New York City media said Kryst died by suicide. Kryst was a highly regarded lawyer at uptown firm Poyner Spruill before being crowned Miss USA in spring 2019, and her passion for social justice led her to sit on national boards of causes like Big Brothers Big Sisters and Dress for Success. On Tuesday, look for a remembrance of Kryst’s life by Ledger managing editor Cristina Bolling in our weekly Ways of Life obituaries newsletter.

Pharma manufacturing heading to Concord: Pharmaceutical giant Eli Lilly & Co. plans to invest about $1B and create 600 jobs in Cabarrus County, at the site of the old Philip Morris plant in Concord. The average wage will be about $70,000. It will make injectable products and devices. It’s the second major investment at the site, which is now known as The Grounds. Last summer, Red Bull, Rauch and Ball Corp. announced a beverage hub at the site (Concord Independent-Tribune)

Manager explains stinky plant: The manager of the New Indy Containerboard plant, which has been the source of a stench in south Charlotte and Upstate South Carolina, said at a news conference: “We let the community down from an overall standpoint. We ran into some issues at start up, and that ended up cascading into more than what we had hoped for.” The company faces lawsuits as well as a $1.1M fine from the Environmental Protection Agency. It initially denied it was the source of the odor. (WFAE)

Auto repair shops filling: Business at Charlotte-area auto shops is way up, after three straight weekends of snow. (WBTV)

Ice cream breakfast: Jeni’s Splendid Ice Creams is asking for the public’s help to set the world record for eating ice cream for breakfast. Someone has declared Saturday “Eat Ice Cream for Breakfast Day,” and Jeni’s locations will be open at 9 a.m. Ben & Jerry’s in Davidson is also opening Saturday at 9 a.m. to serve a $6 “breakfast sundae bar.” (Charlotte on the Cheap)

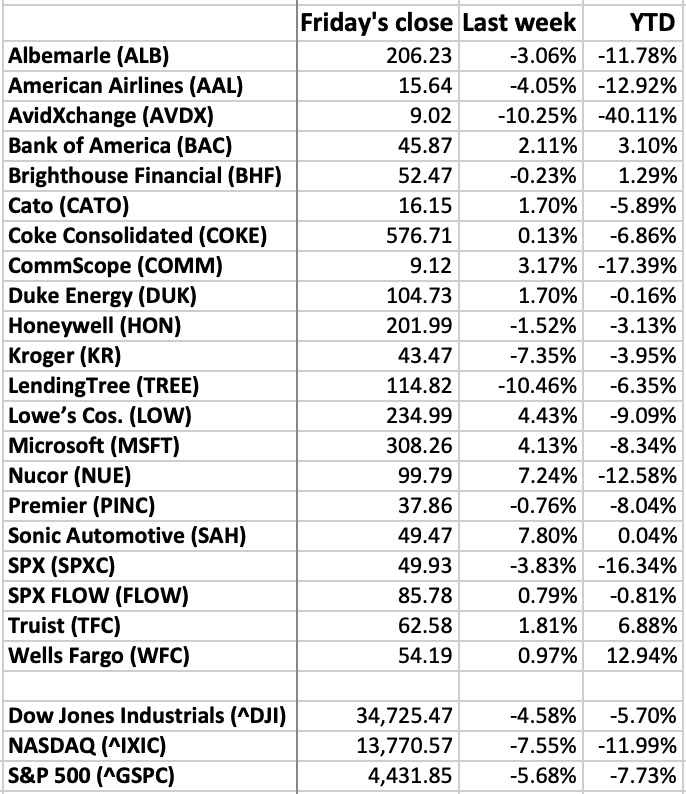

Taking stock

Unless you are a day trader, checking your stocks daily is unhealthy. So how about weekly? How local stocks of note fared last week (through Friday’s close), and year to date:

Need to sign up for this e-newsletter? We offer a free version, as well as paid memberships for full access to all 3 of our local newsletters:

➡️ Learn more about The Charlotte Ledger

The Charlotte Ledger is a locally owned media company that delivers smart and essential news through e-newsletters and on a website. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

Like what we are doing? Feel free to forward this along and to tell a friend.

Change newsletter preferences: Go to ‘My Account’ page

Sponsorship information: email brie@cltledger.com.

Executive editor: Tony Mecia; Managing editor: Cristina Bolling; Contributing editor: Tim Whitmire, CXN Advisory; Contributing photographer/videographer: Kevin Young, The 5 and 2 Project