Meeting minutes shed light on Atrium 'threat'

Plus: Charlotte's big Sun Drop victory; Bessant in the running for Wells job; American grounds 737 Max planes for fourth time

Good morning! Today is Monday, July 15, 2019.

Need to subscribe? Sign up for free here (charlotteledger.substack.com). Like what you see? Forward to a friend.

Did Atrium CFO threaten state panel? Or was he merely explaining the economics of healthcare?

Dedicated readers might recall last month’s brouhaha involving Atrium Health’s chief financial officer and the state’s Local Government Commission. In a June 4 meeting, the CFO, Anthony DeFurio, was alleged to have threatened that Atrium might move out of state if it didn’t get its way from the government panel — which it had asked to back $300M in bonds to refinance debt related to Atrium’s purchase of a Georgia healthcare system.

It’s a snoozer of an issue, to be sure, but some saw the supposed threat as a heavy-handed Atrium move. After a couple days of negative press coverage, DeFurio released a statement saying his comments were “misinterpreted” and that he didn’t intend to make any threat. Mmm-hmm.

Now, though, we have a little more information on what DeFurio actually said. The minutes of that meeting are finally ready, and the Ledger obtained them last week. According to the minutes:

During the discussion period, Mr. DeFurio prefaced his remarks about the importance of Atrium Health’s ability to grow by stating “don’t take this as a threat” (or words to that effect) and then stated that, if this request were not approved and Atrium was unable to grow, Atrium could move out of Charlotte. Subsequently, Mr. DeFurio was asked about that statement, and he clarified his remarks stating that Atrium had no ability to move out of Charlotte and would not do it, but that Atrium would be at a competitive disadvantage if it could not grow.

Unfortunately, that account still leaves the comments open to interpretation:

The charitable interpretation here is that if Atrium didn’t get its way, it would be at a competitive disadvantage that might eventually result in Atrium’s exit from Charlotte.

The less-charitable version would be that his prefacing of the remarks with “don’t take this as a threat” was intended to pressure the commission. It’s sort of like when you start a sentence with “with all due respect” then proceed to say something that sounds disrespectful.

In the end, the commission voted unanimously against Atrium.

State officials say there’s no audio of the meeting, so this is probably the most we’ll know about the issue.

Charlotte soft-drink victory: Sun Drop to be bottled here

It’s not quite on the level of picking up another corporate HQ or hundreds of jobs, but Mecklenburg County will soon pick up additional economic bragging rights. And it’s at the expense of Gaston County.

As the Gaston Gazette ominously put it: “Your opportunity to drink a Sun Drop or Cheerwine bottled in Gastonia is coming to an end.”

Choice USA Beverage, which has bottled drinks in Gaston County for more than 100 years, announced Friday it has reached an agreement to move its manufacturing operations from its Gastonia plant to Independent Beverage Co.’s campus in Charlotte.

Sam Robinson, vice president of sales and marketing for Choice USA., said the manufacturing consolidation with I.B.C. will allow Choice USA to be more competitive in the marketplace, while also helping the company focus on improving the distribution and sale of its many beverage brands.

Independent Beverage Co.’s facility is off I-85 near Brookshire Boulevard.

Sun Drop is owned by Keurig Dr Pepper. Like most soft drinks, it is bottled and distributed by many different companies that are each responsible for a certain territory.

It’s nice to see some of the Carolinas’ most iconic food and beverage brands coming home to Charlotte. Krispy Kreme recently opened a corporate office and donut-tasting facility in South End, Charlotte’s Falfurrias Capital announced last month that it’s buying the parent company of Duke’s Mayonnaise — and now this huge Sun Drop win.

Choice USA Beverage has bottled Sun Drop in its Gastonia plant since 1953. The final Gastonia Sun Drop will roll off the line in September.

But don’t worry — Robinson says Sun Drop will still have that old Gastonia flavor: “It is going to be in Mecklenburg County, but the real Sun Drop people are here in Gastonia — all of our facilities, everything we do. We’re Gastonia people and we’ll be Gastonia people.”

Report: Bessant still in the running for Wells CEO job

Bank of America’s Cathy Bessant is still in contention for the top job at Wells Fargo, according to a Bloomberg report late last week:

After twists and turns in the search, Bank of America Corp.’s Cathy Bessant is among executives who remain in talks with Wells Fargo, while JPMorgan Chase & Co.’s Gordon Smith won’t be taking the job, according to people with knowledge of the situation. Still, directors have yet to settle on a long-term successor for Tim Sloan, who abruptly stepped down in March, the people said, asking not to be named discussing the confidential process.

It’s tough to know exactly where this search is going. That’s because either Wells has done a superb job limiting leaks — or its board has no idea where it is heading. Previous stories have speculated that interim CEO Allen Parker might hold onto the job.

If Bessant lands the job, it could spark local hope and cocktail-party speculation (probably misplaced) that she would move the Wells HQ here, since she lives in Charlotte. (Property records show she owns a $2.5M house in Myers Park.)

Even the usually cynical site Dealbreaker applauded the potential for Bessant’s hire:

Bessant would be a very very strong choice for this gig. She’s the COO and CTO of the second-biggest bank in the land, has decades of top-level experience in pretty much every category Wells Fargo needs to address, and she’s a woman, which has been unsubtly important to the people making the decisions at Wells. So if she wants this terrible job, congrats to everyone on a very good hire!

In brief:

Accountability journalism: A good read by WFAE’s Steve Harrison on a local nonprofit that receives city money to spotlight “zero-waste” businesses that appears to be over budget. City Manager Marcus Jones serves on its board and seems to be lining up city money for the nonprofit without City Council approval, the article says, which he is allowed to do. Government expert tells WFAE there might be “some reasonable concern that maybe [Jones is] not being objective about how much money should go in.”

N.C. sports betting could get green light: The N.C. House is expected to vote today on allowing wagering on sports and off-track horse races. The bill would apply only to Harrah’s Cherokee Casinos in Cherokee and Murphy. The bill’s sponsor says he expects it to pass and that it “will be a jobs driver and an income source for the region.” The Senate passed a version in April. (WFAE)

Home sales fall: Home sales in the Charlotte region dropped 6.1% in June compared with a year earlier, according to data from the Carolina Multiple Listing Services. The average sale price rose 7.1%. Realtors said higher prices are keeping buyers away. (Observer)

New retail/office in Elizabeth: Crescent Communities is planning a four-story, 104,000 s.f. building that combines office and retail space at the corner of Seventh and Caswell streets, on the former site of Jackalope Jack’s and the Philosopher’s Stone. Rezoning hearing tonight. (Agenda, with lots of slick renderings)

American grounds planes again: “American Airlines Group Inc. said on Sunday it is extending for a fourth time cancellations of about 115 daily flights into early November due to the ongoing grounding of the Boeing Co. 737 MAX jets.” (Reuters)

‘Black Friday in July’: Prime Day kicked off this morning, with deals from Amazon. And other retailers including Walmart and Target are jumping in and discounting. Wired has a comprehensive piece with some of the best deals and links.

Fun light read: “12 quick episode ideas if Seinfeld took place in Charlotte” (Agenda). Example: “Kramer rediscovers the nexus of the universe when he finds himself at the corner of Queens and Queens.”

Taking stock

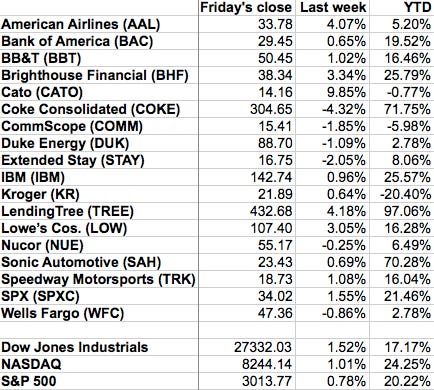

Unless you are a day trader, checking your stocks daily is unhealthy. So how about weekly? How local stocks of note fared last week (through Friday’s close), and year to date:

Banks to report earnings amid big stock gains

It’s going to be a big week for bank stocks:

Wells Fargo reports earnings Tuesday morning.

Bank of America reports Wednesday morning.

BB&T and SunTrust report (separate) earnings Thursday morning.

Bank stocks are already up big on the year, Barron’s says — oh, except for Wells Fargo:

After being hammered in the fourth quarter of last year, bank shares have recovered significantly in 2019. The first bank to report, Citigroup, is up 38% this year, compared with about 20% for the broader S&P 500 index.

Bank of America shares have risen 20%, while Goldman Sachs stock is up 28%. JPMorgan Chase shares have gained 18% and Morgan Stanley is up 13%. Wells Fargo, still laboring under a Federal Reserve-imposed balance-sheet cap and without a permanent chief executive, is up just 3%.

Despite their climb back from their late-2018 thrashing, it’s hard to see the current environment as a positive one. A dovish turn by the Fed, the continuing U.S.-China trade war, worries of an economic slowdown, likely lower investment-banking revenue, and a seemingly secular fall in trading profits are likely to keep a lid on big bank shares.

Got a news tip? Think we missed something? Drop me a line at editor@cltledger.com and let me know.

Like what we are doing? Feel free to forward this along and to tell a friend.

The Charlotte Ledger is an e-newsletter and web site publishing timely, informative, and interesting local business news and analysis Mondays, Wednesdays, and Fridays, except holidays and as noted. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

The Charlotte Ledger is published by Tony Mecia, an award-winning former Charlotte Observer business reporter and editor. He lives in Charlotte with his wife and three children.