Retired Heafner investor 'devastated,' lawyer says

Life of 62-year-old Charlotte woman 'is going to be completely changed now'

PLUS: Understanding big med school announcement; Charlotte Pipe capitalists reverse course; Starbucks to revamp coffee rewards

The Charlotte Ledger

Fresh and real Charlotte business news that makes you smarter. Delivered to your inbox for free three days a week.

Need to subscribe? Sign up here (charlotteledger.substack.com). Forward this to your friends.

Programming note: There will be no Ledger next week. Fear not, we will be back on a regular schedule on Monday, April 22.

Good morning! Today is Friday, April 12, 2019. There’s a lot going on in Charlotte-area business news. Let’s get to it:

Life ‘completely changed’ for Heafner client who lost $130K

A 62-year-old retired Charlotte bank employee is “devastated” after the $130,000 she gave to local TV and radio financial pitchman Jim Heafner turned into nothing, her lawyer tells The Charlotte Ledger.

The lawyer, Dax White of the White Law Group in Vero Beach, Fla., says his client is an unsophisticated investor who entrusted Heafner with her retirement money: “She bought it because she thought it was safe and would provide income. This was her retirement. … It’s unlikely she will be back in the position she was in before. Her life is going to be completely changed now.”

White declined to identify his client. He says she is “spooked.”

The woman’s saga puts the first human face on the drama surrounding Heafner, the financial adviser who dispensed investment wisdom on morning shows on WCNC, WBTV and WSOC and on news-talk radio station WBT. The segments sounded like honest discussions of personal finance but were actually paid advertising. Heafner’s role came to light a couple weeks ago, after the Charlotte Business Journal reported that he sold unregistered securities on behalf of a Florida company called 1 Global. (Previous Ledger coverage here and here.)

Greece vacation, Mercedes Benz: The SEC says in a civil filing that 1 Global misrepresented the investments as safe for retirement accounts — when in fact 1 Global used the money for risky investments and diverted some of it to other businesses and to cover its CEO’s “lavish expenses such as a luxury vacation to Greece and monthly payments for his Mercedes Benz.” The SEC alleges 1 Global, also called 1st Global, fraudulently raised $287M from 3,400 investors nationwide. 1 Global was headed by the former owner of porn mags Playgirl, High Society and Cheri.

White’s client is one of three who have filed Heafner-related complaints with FINRA, the brokerage industry’s regulatory body. Investors can’t sue in regular court because of arbitration clauses. FINRA records are not publicly available.

The complaint White’s client filed with FINRA — which he shared with the Ledger — says she met with Heafner in December 2017. That’s about the same time he was regularly appearing on Charlotte TV and radio:

Claimant told Heafner that she was looking for conservative growth to prepare for retirement. Claimant also told Heafner that she had a low tolerance for risk and that she could not afford to lose her principal. Heafner represented that he understood Claimant’s investment objectives and could meet her investment needs. Relying on these representations, Claimant entrusted Heafner with a substantial amount of her retirement savings.

Notwithstanding Claimant’s specific investment objectives, Heafner invested more than $130,000 of Claimant’s assets in the 1st Global Capital unregistered security, creating a portfolio for her that lacked proper diversification and over-concentrated her assets in a single high-risk, high-commission paying product.

White said he wasn’t sure how his client found Heafner. But he said he’s not surprised Heafner bought air time. Advisers who appear on TV and radio shows often pitch high-commission financial products: “The guys who do the Sunday morning call-in expert shows are the ones who end up in this.”

“Selling away”? His client’s complaint is actually against Taylor Capital Management, a Georgia brokerage firm that employed Heafner. (“I don’t like to sue advisers. In my experience, they never have any money ,” White says.) The company did not respond to an interview request. In response to the complaints, it has said it did not know Heafner was selling the 1 Global securities — a practice known in the industry as “selling away.” The complaints say Taylor Capital Management should have supervised Heafner.

Heafner told WBTV last month that he didn’t know the securities he sold were risky: “Everything looked safe as it could possibly be.”

Asked about other victims, White said he knows there are others, but they might not have filed complaints: “I know there are a bunch more people in Charlotte.”

How big a deal is this med school?

Charlotte’s getting a medical school, happy days are here again, and yes, we live in a truly a world-class city!

That was the tone of the announcement on Wednesday that Atrium Health, Wake Forest University and Wake Forest Baptist Health are working together on a four-year medical school in Charlotte. The phrases were lofty: “transformative academic healthcare system … ground-breaking research and innovation … state-of-the-art campus in Charlotte … enriching countless lives and communities throughout North Carolina, the Southeast region and the nation.”

It’s exciting news, thrilling really, since Charlotte has long had an inferiority complex when it comes to higher education. A previous med-school effort between Atrium and UNC Charlotte was dead in the water.

A med school, the thinking goes, would establish Charlotte as a hotbed of cutting-edge medical research. As a city, it would complete us — like an improbable partner in some romantic comedy.

Sometimes, though, saying what you don’t know is as important as saying what you do know. And in trying to assess how big a deal this is, there’s a lot we don’t know. Could this have real significance, like a mega-bank merger of the 1990s that leads to thousands of high-paying jobs? Perhaps. Or could this be like the inaugural US Airways flight to Paris – a nice feather in the city’s cap but with little significance besides bragging rights? Yeah, that’s possible, too. The truth probably lies somewhere in between.

Despite all the hoopla, what Atrium and Wake actually announced Wednesday was that they had signed a memorandum of understanding – essentially an agreement to keep talking. That’s like where you would be if you went on a few dates with somebody and developed an understanding. It doesn’t mean you will get married. (And you don’t have teams of doctors with big egos second-guessing your every decision, either.)

Here are some educated guesses on some of the effects of a Charlotte medical school:

Students

We don’t know how many medical students we are talking about, but it is probably not more than a few hundred. For a four-year medical degree, UNC Charlotte considered starting with a class of 25 students and eventually working up to 50.

Wake Forest currently has 510 medical students, or roughly 125 per class. State regulators don’t have to approve any increases. We don’t know if Wake would shift some of those seats to Charlotte or just add them here. Wake is one of the most selective med schools in the country, with an acceptance rate of less than 2%. Atrium and Wake would also work together on other medical education, like physicians assistants and nursing – Atrium already has more than 400 of those students here.

Real estate

Speculating where this new medical campus will go will be a fun parlor game. Will Atrium continue gobbling up property in Dilworth? Could it go somewhere uptown, where Wake already has a presence (near the Spectrum Center)? A medical school requires classrooms, offices and labs. UNC Charlotte estimated the cost of a new 90,000-square-foot medical building at $50M.

Doctors

Consultants have said that Charlotte faces a doctor shortage in coming years, particularly in primary care and psychiatry. One of the reasons UNC Charlotte passed on a med school is that it believed a med school will not result in that many more doctors staying here. Historically, only 18% of North Carolina medical students wind up practicing primary care in the state. Charlotte has about 5,400 physicians.

Research

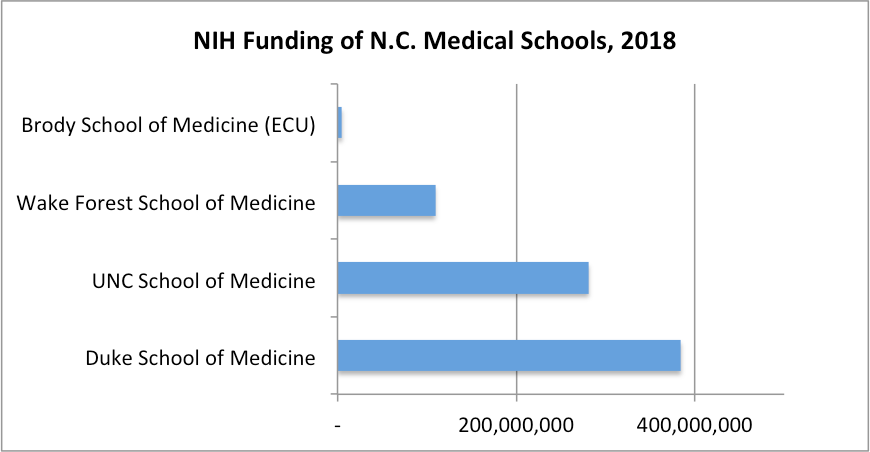

We don’t know how much medical research might be done here vs. at Wake Forest. But if Charlotte lands at least some research funding, that could have ripple effects into the local economy. It could lead to Charlotte developing medical-research companies, which the city is now lacking. The Triangle and Triad have many more. Even Winston-Salem has a solid base of medical start-ups. Wake Forest’s medical school last year received about $109M in funding from the National Institutes of Health.

Source: NIH

Quote: “My expectation would be that it would lead to innovation in that space that would manifest itself in more interesting Charlotte-based start-ups in the medical and healthcare space.” – Greg Brown, administrator, Charlotte Angel Fund, which invests in start-ups.

Bottom line: A medical school could be a big deal for Charlotte. Or it could be a small satellite campus of Wake Forest. In the absence of information, our minds fill the void with great hopes and dreams. Let’s keep expectations in check until more details emerge.

Free markets for thee, not for me

Frank Dowd IV, chairman of Charlotte Pipe and Foundry, is one of the few Charlotte business executives who calls it as he sees it on politics. He’s outspoken about his love for the free market and his antipathy toward socialism.

“Big spending on lavish benefits is just the means to an end,” he pronounced last year in the North State Journal. “… The left wants power to finally end America’s 229-year experiment in ordered liberty, limited government and free-market capitalism.”

Preach!

Then there’s this piece from the Observer in 2017: “Capitalism and free enterprise, not socialism and welfare, have proven to be the key to prosperity. … Why aren’t more leaders, academic and otherwise, putting forth a spirited defense of free enterprise?”

Tell it!

Yep, mark Frank Dowd down as one of Charlotte’s biggest defenders of free markets and capitalism. Got it. Wait, what’s that? We should look at an article in yesterday’s Biz Journal? Well, ok.

Headline: “NC legislators are working on $154M incentive package to keep Charlotte Pipe plant”

Say what?

Charlotte Pipe & Foundry is considering moving its metal pipe manufacturing operation out of the high-dollar area south of uptown to South Carolina or a rural county in the Charlotte region. The N.C. General Assembly is working on incentive legislation to help keep the estimated $325 million project in North Carolina. …

Brad Muller, Charlotte Pipe vice president of marketing, says the company would be open to a better use of the more than 20 acres on which the company makes all of its metal pipe products. But for now, the company is satisfied to remain in place.

“We are open to whatever is best for the business,” Muller told the Charlotte Business Journal Thursday morning.

Seems as though Charlotte Pipe likes free markets in theory. In practice, though, it’s open to corporate welfare. “Big spending on lavish benefits,” indeed.

It probably makes sense to move a century-old plant away from the center city, and don’t count on preservationists to object on this one. A 20-acre site near uptown, as we all know, is better-suited in 2019 to breweries and luxury apartments. (If you’re an environmental consultant, the site could be a big business opportunity.) But if the capitalists at Charlotte Pipe choose to decamp from their valuable uptown real estate to a more suitable location, perhaps taxpayers should insist they do it on their own dime.

Let’s see if anybody in Raleigh puts forth a “spirited defense of free enterprise.”

Understanding the N.C. insurance bribery scheme

If you’re struggling to understand this North Carolina bribery scandal involving a Durham businessman, GOP operatives and the state’s insurance commissioner, WFAE has a helpful interview with the Wall Street Journal reporter who has been reporting on the businessman’s company — and what it potentially sought from state insurance regulators.

Article here.

In brief

Sued: A Florida media consultant has sued Charlotte’s Bahakel Communications, owner of WCCB and a handful of other TV and radio stations, for reneging on a contract. The suit, filed this month in Mecklenburg County, alleges that Beverly Bahakel Poston, the company’s president, signed an agreement to pay Twelve 24 Media of Palm Beach Gardens, Fla., $175K for “growth and development of new revenues and branding” but backed out.

Charm offensive in NYC: Charlotte Mayor Vi Lyles and City Manager Marcus Jones hit the Big Apple this week, talking up Charlotte to reporters and editors in a PR offensive that hit NPR, NBC, the Wall Street Journal, TechCrunch and Bloomberg.

Job shift: Red Ventures is moving about 260 call-center workers from the UNC Charlotte area to its HQ in South Carolina, the Observer says.

Home sales: The number of residential closings in the Charlotte area fell by 6% in March compared with a year earlier. The average sales price rose 3%.

Food and booze news

A weekly wrap-up of the week’s eating and drinking developments

Coffee loyalty: Starbucks launches a new rewards program on Tuesday that makes it easier to redeem rewards but also eliminates cherished “gold” status.

A brewery? In NoDa? D9 Brewing examines a space on North Davidson Street. (Biz Journal).

A bar? In South End? Neighborhood bar and restaurant QC Pour House opens next month on Tremont Avenue. (Agenda)

Chick-Fil-A watch: Newly reopened: Chick-Fil-A at the Arboretum, after an eight-month remodel. Opens today: Prosperity Church Road, near Highland Creek subdivision just north of I-485.

Got a news tip? Think we missed something? Drop me a line at editor@cltledger.comand let me know.

Like what we are doing? Feel free to forward this along and to tell a friend.

The Charlotte Ledger is an e-newsletter and web site publishing timely, informative, and interesting local business news and analysis Mondays, Wednesdays, and Fridays, except holidays and as noted. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

The Charlotte Ledger is published by Tony Mecia, an award-winning former Charlotte Observer business reporter and editor. He lives in Charlotte with his wife and three children.