Rising rates add urgency to house-hunting

Plus: Will old Epicentre owner be a bidder this week for the Epicentre?; Charlotte moving slowly on social districts; April's hot rezonings 🔥; S.C. earthquake; Restaurant The Stanley to close

Good morning! Today is Monday, May 9, 2022. You’re reading The Charlotte Ledger, an e-newsletter with local business-y news and insights for Charlotte, N.C.

Need to subscribe — or upgrade your Ledger e-newsletter subscription? Details here.

Today's Charlotte Ledger is sponsored by By George Communications, which helps people, companies and organizations raise their visibility and credibility through storytelling and PR.

As mortgage rates hit highest levels since 2009, local Realtors say buyers are eager to avoid bigger house payments

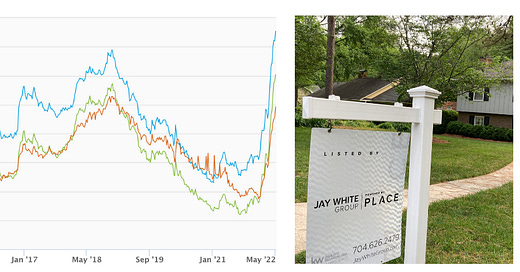

Interest rates on 30-year fixed mortgages (blue line) have zoomed above 5% and are at the highest levels since 2009. Local real estate agents say they are still busy but are seeing some changes in homebuyers’ behavior, such as wanting to lock in rates before they go up further. (Source: Freddie Mac; green line is 15-year fixed rate, orange line is 5-year adjustable rate)

by Tony Mecia

You can’t quite say that Charlotte’s red-hot housing market is cooling off, but local real estate agents say they’re starting to see some effects of sharply higher interest rates.

The Federal Reserve last week raised interest rates by 0.5 points — its biggest one-time adjustment in more than 20 years — as it tries to counter inflation that’s pushing the cost of many goods and services sharply higher.

But as a result of the Fed’s efforts over the last few months, mortgage rates are moving higher, which adds to the financing cost of buying a house. The average rate on a 30-year fixed mortgage was 5.27% last week, according to the latest Freddie Mac survey — up from 2.96% a year earlier. It’s at its highest level since 2009, but still lower than the decades preceding that.

In the last two years, Charlotte-area real estate agents have generally described wild competition for houses: multiple bids over asking price, people camping out for lots, buyers waiving inspections and so on.

And prices have been surging: The median sales price of a Mecklenburg house was $403,250 in March, 19% more than a year ago, according to the Canopy Realtor Association. Axios Charlotte last week reported on a 968 s.f. “bungalow” built in 1940 off Tuckaseegee Road in west Charlotte that is on the market for $250,000 — even though it has no kitchen.

The Ledger reached out to five local real estate agents late last week to gauge the effect of rising rates on the Charlotte market. They said that although it’s too soon to say with certainty that higher rates are slowing the demand for local housing, they are seeing some effects, including:

Urgency to get deals done. As rates increase, some buyers want to finish a purchase and lock in a mortgage rate before rates go even higher.

Interest in ARMs: Adjustable rate mortgages have lower rates than 30-year fixed mortgages, and statistics show the share of ARMs nationally is increasing: about 9% of mortgages today are ARMs, twice the share from three months ago, according to the Mortgage Bankers Association.

Bigger down payments: One way to counter rising rates is to finance less, and some buyers are opting to close with bigger down payments.

Tougher on first-time home buyers: Rising mortgage rates have the biggest effect on the buyers who are most price-sensitive — those at the lower end of the market, many of whom are buying their first houses. One agent told us he has had no buyers in the $200,000-$400,000 range in the last few months, which was a challenging range in which to find a house to begin with.

Here’s what local real estate agents told The Ledger last week about the current state of the Charlotte housing market:

Jennifer Jackson, Allen Tate: Bigger down payments

I am seeing some luxury inventory sit, with few showings.

I actually had someone talk to me about an adjustable rate mortgage this week. I haven't had anyone mention ARMs in a long time.

Cash also seems to be more prevalent. American consumer balance sheets are at an all-time high, and with the shock of the recent rate increases (although still historically low), I am seeing more people opt to go with bigger down payments or simply pay cash for the asset.

Ducie Stark, Dickens Mitchener: Buyers eager to get under contract

I think that is too early to see the true impact that rising rates will have on our market. In the short term, buyers continue to be anxious to secure a contract and lock in a favorable interest rate. Even with the increases, the rates are still lower than past markets.

The Charlotte and surrounding markets are so strong right now that it will be interesting to see if the rates impact the incredibly high consumption rate.

Jessica Grier, Premier Sotheby's International Realty: Buyers getting off the fence

It’s gotten some people off the fence, if anything. As things are going up, they’re a little more intrigued.

The rates weren’t going any further down. At the lowest price point is where you are going to see an effect on a lot more people.

I feel like that it might be slowing down a little bit, just from listings we have in uptown. From what I can tell based on what I have listed, property isn’t selling under asking price. But it may be taking a little bit longer.

David Huss, Allen Tate: Slower housing market ahead?

When interest rates are somewhat flat, people tend to be ho-hum about making something happen. But when they make a big move, people take action. For years, we saw people riding the wave down. Now, it’s like they have to do something ASAP because a rate change of 1% could add hundreds of dollars to the monthly payment, and they want to act. I think a lot of these people have jumped into the market the past 4-6 weeks.

We have been seeing multiple offers on properties still and with vigor. Meaning, I am seeing and hearing of people offering over list price and high due diligence fees just to get something and avoid the rate hike that catches them.

I think this next round of increases is going to put the brakes on a lot of things. Not meaning things come to a halt, but slow it down. The housing market has been unhealthy for a while, and we need to get back to some sense of normalcy.

I haven't had any first-time buyers over the past couple months, nor people at, say, the $200K-$400K range. That is where the rate change will have its most immediate impact. It’s all about the payment. The higher you go in price, the sensitivity to the rate change is less dramatic.

Catharine Pappas, Dickens Mitchener: Buyers moving quickly

Mortgage rates in the US have risen sharply over the last year from 3.18% to over 5%. Rates have not risen this fast since 2011. To date, rates have not had a negative effect on buyer demand.

Buyers moving to Charlotte from higher-taxed states still find value in Charlotte, with our comparatively lower cost of living and award-winning lifestyle. The threat of higher rates has encouraged buyers to lock in rates and move as quickly as possible to find the perfect home.

Buyers are aware that every tick up of mortgage rates reduces their buying power, but so far we have not seen it affecting buyer behavior or demand.

Today’s supporting sponsors are T.R. Lawing Realty…

… and Whitehead Manor Conference Center, a peaceful, private, and stress-free space for your organization’s next off-site meeting or event. Conveniently located in South Charlotte, Whitehead Manor is locally owned and operated and provides modern meeting capabilities with attention to stellar service!

Epicentre auction: Will the new owner be the same as the old owner?

Uptown’s Epicentre is scheduled to be sold in a foreclosure auction on Thursday, and one of the more intriguing questions swirling around the sale is whether its old owner wants to get it back.

Real estate types in Charlotte have been buzzing lately about the possibility that CIM Group — the parent company of EpiCentre SPE LLC, which defaulted on an $85M loan — could be a bidder for the property. That might seem odd, given that it was on CIM Group’s watch that the whole Epicentre operation fell into disrepair and disarray.

CIM Group paid $131M in 2014 for the Epicentre, according to media coverage at the time. Today, at 70% vacant, it’s probably worth much less. Allowing a property to go into foreclosure and then buying it back at a fraction of the price sounds like a total real-estate-shark move.

CIM Group might be such a shark. It isn’t some down-on-its-luck small real estate investor. Based in Los Angeles, the company has about 1,000 employees and $30B in assets. “Our focus on enhancing communities is unwavering, and we’re striving to make an even greater impact in the years to come,” its website proclaims. Mmm-hmm.

We’ll see what happens this week. The consensus locally seems to be that the Epicentre will need at least some cosmetic changes and a new name. —TM

Foot-dragging on Charlotte social districts; ‘Making this way, way harder than it has to be’

Eight months ago — in September 2021 — North Carolina’s General Assembly passed a law allowing cities to designate areas where people could — get this — carry open containers of alcohol.

As The Ledger reported at the time, City Council members and businesses were interested in creating social districts in Charlotte, and they were brainstorming places where those districts might make some sense. (If you guessed uptown and South End, you would be right, though since then, other areas such as Plaza-Midwood have said they, too, are interested.)

Fast forward to today, May 2022. Greensboro, Kannapolis, Monroe, Newton and Norwood have established social districts, The Observer reported last week, and Albemarle, Cornelius, Hickory, High Point, New Bern, Salisbury, Sylva, Waxhaw, Wilmington and Winston-Salem have approved the districts or have them under consideration.

Did you notice what city is not on the list? Yeah, Charlotte.

City staff sent a note to council members last week that it will take another three to five months for the city to move on social districts, WSOC reported. That’s because the city needs to plan, coordinate with outside agencies and change ordinances. You might wonder how Newton, Norwood and Kannapolis have all managed to make it happen, while Charlotte, with more than 7,000 city employees, says it needs a year or more after legislation is passed to get its act together.

In response to some discussion on the issue on Twitter last week, Andy Ellen, president of the N.C. Retail Merchants Association, weighed in with what might be called trolling but that might be also called making sensible points:

Making this way, way harder than it has to be — should just call [Greensboro] and ask for the blueprint for a large city to successfully implement a social district.

And if you wait 3-5 months you miss the window of good weather for the spring, summer & fall — those retailers, restaurants & bars need all the help they can get after dealing with COVID. Would think with how desolate Uptown Charlotte is this would be a no brainer.

When the great small towns of Franklinton and Norwood with populations of less than 3K successfully implement social districts with limited resources it makes you wonder why Charlotte needs 3-5 months.

The City Council meets tonight. Social districts are not on the agenda, but several council members say they want to discuss them. —TM

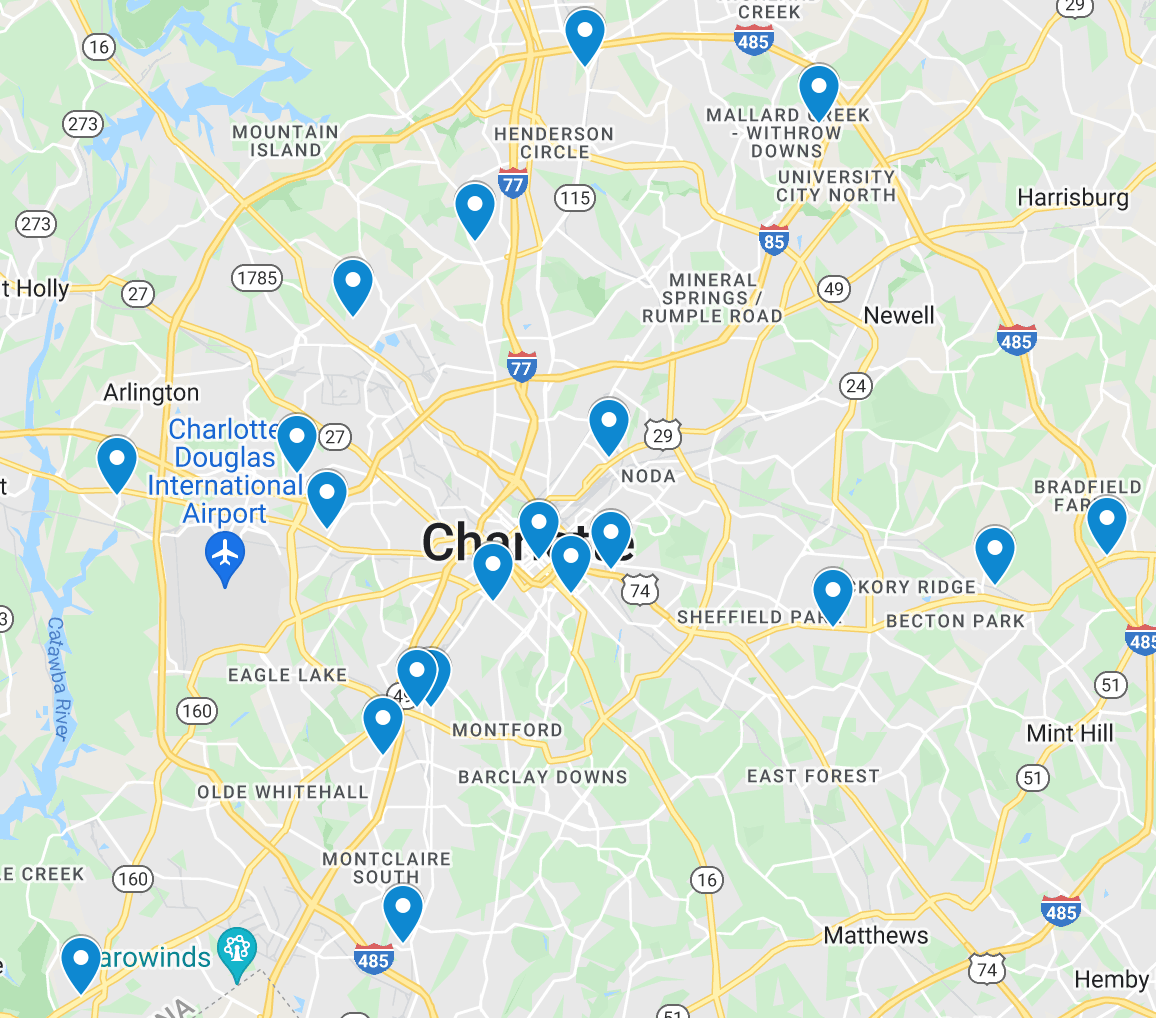

Rezoning time: We’ve got the list for April

It’s everyone’s favorite time — no, not spring in Charlotte, but The Ledger’s monthly list of Charlotte rezoning filings!

We deployed Ledger worker bees🐝 to sort through city rezoning filings and deliver the goods: summaries of every rezoning plan filed by developers in the previous month. The summaries provide a glimpse of what’s planned to be built all over Charlotte — and maybe in a neighborhood you care about. Here are the sites for which developers filed plans last month:

Our list of rezoning filings is typically the first look you’ll have at what’s up. Even the city’s main rezoning website doesn’t have them yet.

Last month, developers filed plans including:

100 townhomes off N.C. 16

370 residential units near the River District

Permission to erect a sign on the Commonwealth development in Plaza-Midwood

236 townhomes on Beatties Ford Road in west Charlotte

310 apartments on Albemarle Road in east Charlotte

And there’s plenty more. Check it out:

We make the monthly rezoning list available only to our community of paying members (🔒).

Enjoy! —TM

In brief:

Elizabeth restaurant closing: Popular Charlotte restauranteur Paul Verica announced Sunday that he’s closing his Elizabeth fine dining restaurant, The Stanley, this Friday. The restaurant opened in 2018. It regularly appeared on lists of Charlotte’s top restaurants, including Charlotte magazine’s “50 best restaurants in Charlotte: 2022.” Verica wrote on Facebook: “The last two years have been difficult for everyone in our beloved industry, to say the least, and I feel the effect deeply. For me, it has been a good ride — great and even magical at times — but for me it’s time for this ride to come to an end.”

South Carolina earthquake: Parts of South Carolina were jolted this morning by a 3.3-magnitude earthquake centered 20 miles northeast of Columbia. It hit at 1:30 a.m. Monday. There were no reports of damage. (WSOC)

Graduation time for Rameses mascot: Huntersville native Daniel Wood, a UNC Chapel Hill senior from Huntersville who graduated Sunday, has hung up his horns after spending four years as the UNC Rameses mascot. “You need to be able to enjoy the small appearances, because there are no small appearances — where you may just be going to a child’s birthday party or a nonprofit organization’s fundraiser where there might be two people there,” Wood told WSOC. “You have to be able to enjoy those moments because if you don’t, you don’t deserve the Final Fours.”

Reproductive rights protest: Hundreds of people gathered in Freedom Park on Sunday to protest in favor of abortion rights. (WCNC)

Upswing in golf: Interest in golf dipped in the two decades prior to the pandemic, but since 2020, demand for the sport has taken off, Axios Charlotte reports. Greens fees have increased 10 to 20% at Charlotte-area public courses, with the average weekend rate now $60 and up. Private golf clubs that previously saw membership slumps now have wait lists of 6 months or more.

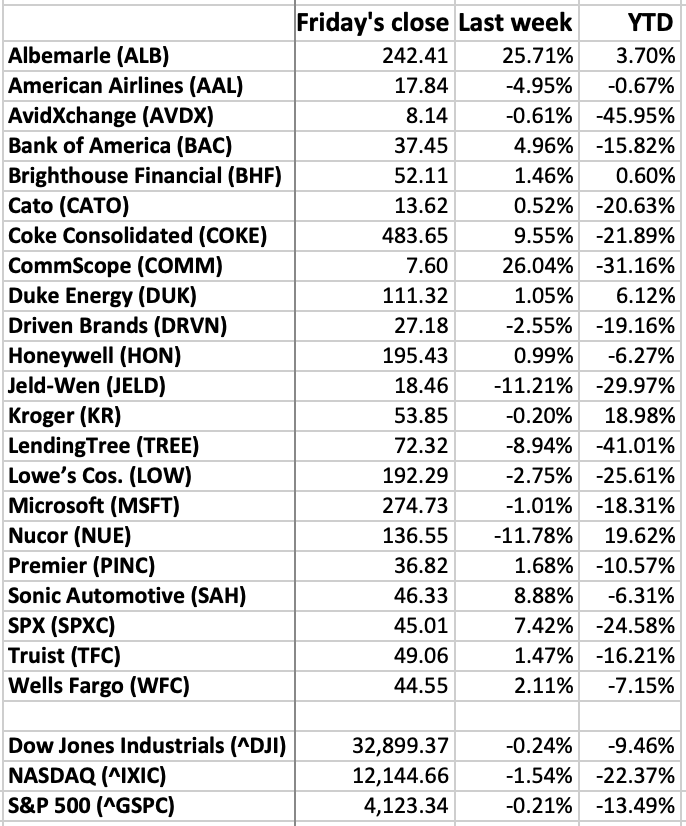

Taking stock

Unless you are a day trader, checking your stocks daily is unhealthy. So how about weekly? How local stocks of note fared last week (through Friday’s close), and year to date:

Need to sign up for this e-newsletter? We offer a free version, as well as paid memberships for full access to all 4 of our local newsletters:

➡️ Opt in or out of different newsletters on your “My Account” page.

➡️ Learn more about The Charlotte Ledger

The Charlotte Ledger is a locally owned media company that delivers smart and essential news through e-newsletters and on a website. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

Like what we are doing? Feel free to forward this along and to tell a friend.

Sponsorship information: email brie@cltledger.com.

Executive editor: Tony Mecia; Managing editor: Cristina Bolling; Contributing editor: Tim Whitmire, CXN Advisory; Contributing photographer/videographer: Kevin Young, The 5 and 2 Project