The future of finance

Plus: American Airlines returns to full strength with 7 European flights in 2023; Join us for economic outlook panel on Jan. 4; Nourish your brain with a local podcast; November's rezonings

Good morning! Today is Tuesday, December 20, 2022. This is a SPECIAL BONUS ISSUE of The Charlotte Ledger, an e-newsletter with local business-y news and insights for Charlotte, N.C.

Need to subscribe — or upgrade your Ledger e-newsletter subscription? Details here.

Editor’s note: Because of the holidays, this is our last regular newsletter this year. Our usual schedule will resume the first week of January.

Today's Charlotte Ledger is sponsored by GraserSmith:

Experience when you need it most.

At GraserSmith, we are exclusively focused on providing personalized advocacy in family matters of divorce, child custody, child support, alimony, property division and prenuptial agreements.

Q&A: Retiring credit union CEO on the economy, the future of financial services — and why banks still have all those branches

Bill Partin, the retiring CEO of Sharonview Federal Credit Union, says partnerships with financial technology companies, or fintechs, will continue to drive innovation in financial services. (Photo courtesy of Sharonview Federal Credit Union)

Bill Partin started his career as a drive-up teller at a California bank. Now, 42 years later, he’s retiring at the end of this month as the CEO of Fort Mill-based Sharonview Federal Credit Union, which has more than 100,000 members and 19 branches in the Carolinas.

Partin, 62, spoke with Ledger editor Tony Mecia this month about changes in the financial services industry over the last four decades, his outlook on the economy and technological innovation. Remarks were edited for clarity and length.

Q. So what has changed in financial services in the last 42 years?

It’s been fun to think back. I started in commercial banking, back when the savings and loans were big.

For me, what's been interesting to watch is the consolidation of the industry. We look across the pond, and we see, like, four major banks in Europe. People are asking, “Hey, are we headed in that direction?”

Q. Where do you see this industry headed?

Fintechs that have shown up — these small, really nimble, fast, smart people that have come in and created products and services — I think that's going to continue. When you look at the big guys — the BofAs, the Wells Fargos, the Truists — they’ve got the deep pockets. They can spend the money on the technology.

We're good size credit union —we're in the top 250 out of 5,000 credit unions. We don’t have the pockets they have, so we're beginning to form partnerships with these small, nimble fintechs. More of that’s going to happen.

I think that the industry is going to continue to consolidate. Besides consolidation, I think we're going to have to continue to cooperate with each other as we work to provide a good competitive landscape against the big guys and provide options for consumers. I think that's what credit unions are really all about.

Q. A question I get all the time from people is: “If everything is going to digital banking, why are all these banks and financial institutions opening up branches all over the place?”

There are folks who say, “Branches are dead. They're going away.” That’s kind of a minority voice.

When you study the data, folks still find value. We’re starting to pick up more millennials, more [Gen] Z-ers, which is great. And they are definitely doing business digitally.

But I will tell you: There are still what I call “moments that matter.” When you're buying your first home, or you need help with your credit score, yeah, you can talk to someone on the phone. But sometimes, people want to get together face-to-face. We are finding folks still want to come in when they open an account. There is still some financial guidance that folks want.

We don’t need these behemoths. Our footprint is about 1,800 to 2,300 square feet. We made them small. We made them open. We blew up all our teller lines — we don't have teller lines. We used our pods.

If you need some help with a mortgage, we've got a mortgage loan officer typically sitting in the branch. If not, we can connect you via Teams or Zoom. We do all our wealth management business still pretty much face-to-face — folks who are saving for college or for retirement or for a home. So I still believe that there’s a spot for branches. I think what you're going to see is probably the continued shrinkage of space.

Q. Nobody has a crystal ball, but what sort of signals are you seeing on the economy, in terms of the deposits that you have, how consumers are spending their money, lending, that kind of thing?

Interesting dynamics. We’re seeing still a high degree of interest with our consumer loans around auto loans and personal loans. Folks that normally have been in a used car 24 or 26 months, we're starting to see that lengthen. Folks are getting their cars repaired.

Our mortgage market just dried up. We had a lot of folks lock in at low rates. But we saw our pipeline really kind of dry up from a mortgage perspective, because rates went up. I'm a believer right now we're in a recession.

We've seen just a slow rise in delinquencies and charge-offs at this point in time. We're budgeting for that to increase through 2023. It’s literally just been the last two months that we’ve actually seen our charge-offs blip up a bit.

We're starting to hear of people laying people off, right? So we’re going to start to see people not being able to make payments. We take a lot of pride in working with our members making sure they stay in their cars, stay in their homes.

I wish I had a great crystal ball. I would be probably on an island somewhere sipping a drink.

Q. Any parting words of advice?

The one thing I wanted to share with you that I’ve really kind of made my mantra here is a guy named Jim Rohn had a quote that I’ve adopted: “Work harder on yourself than you do on your job.” I just love that personal development angle. I’ve always been a big fan of trying to be a better version of Bill today than I was yesterday.

It’s something I went public with about two years after I got here. And I said, “This is going to sound strange coming from the CEO, but if you bring your ‘A’ self into the shop — because we know you’re a whole person, you’ve got family, you’ve got friends, you’ve got a life outside of here — I think that’s going to make a difference in the lives of our 114,000 members.” I can’t say it’s 100%, but from the engagement work we do, and from the comments we get from our staff, they feel good about what they do here. And that makes me feel good.

American Airlines returns to full strength on Europe flights: 7 transatlantic cities in 2023

Charlotte will have a full slate of transatlantic destinations next summer, with American Airlines planning daily flights to seven European cities.

The 2023 destinations are Dublin, Frankfurt, London, Madrid, Munich, Paris and Rome, with all the flights aboard Boeing 777-200s seating 273 passengers.

Currently, Charlotte’s transatlantic destinations are limited to London, which has two daily departures, and Frankfurt and Munich, which each have one daily departure.

The expanded transatlantic service will start to ramp up in March 2023 and last into the fall:

Madrid flights will begin March 26 and end Oct 27.

Rome will begin April 4 and end Oct 27.

Dublin will begin May 4 and end Oct. 27.

Paris will begin June 1 and end Oct. 4.

The restoration of Paris brings Charlotte transatlantic service back to its pre-pandemic level. During the summer of 2022, American flew from Charlotte to six of the seven cities it will serve in 2023, with Paris excluded.

While seven transatlantic destinations from Charlotte is the peak for American Airlines, the number was exceeded in the summer of 2013, when Charlotte was a hub for American predecessor US Airways, which offered daily service to 10 European destinations.

The 10 cities included Barcelona, Brussels, Lisbon and Manchester as well as six of the current seven, with Munich excluded. US Airways had built service from April 2009, when the only transatlantic destinations were Frankfurt and London.

Once US Airways merged with American at the end of 2013, more passengers moved through Charlotte Douglas, but also American had far more options for transatlantic service, including Dallas and New York Kennedy, as well as Philadelphia, which had been US Airways’ primary European gateway.

Since the merger, American executives have said several times that Charlotte is in line for more transatlantic service, but an increase depends on deliveries of new widebody airplanes including Boeing 787s, which are currently in short supply.

Charlotte’s first transatlantic flight was in June 1987, when hub carrier Piedmont Airlines inaugurated London service with a newly acquired Boeing 767. —Ted Reed

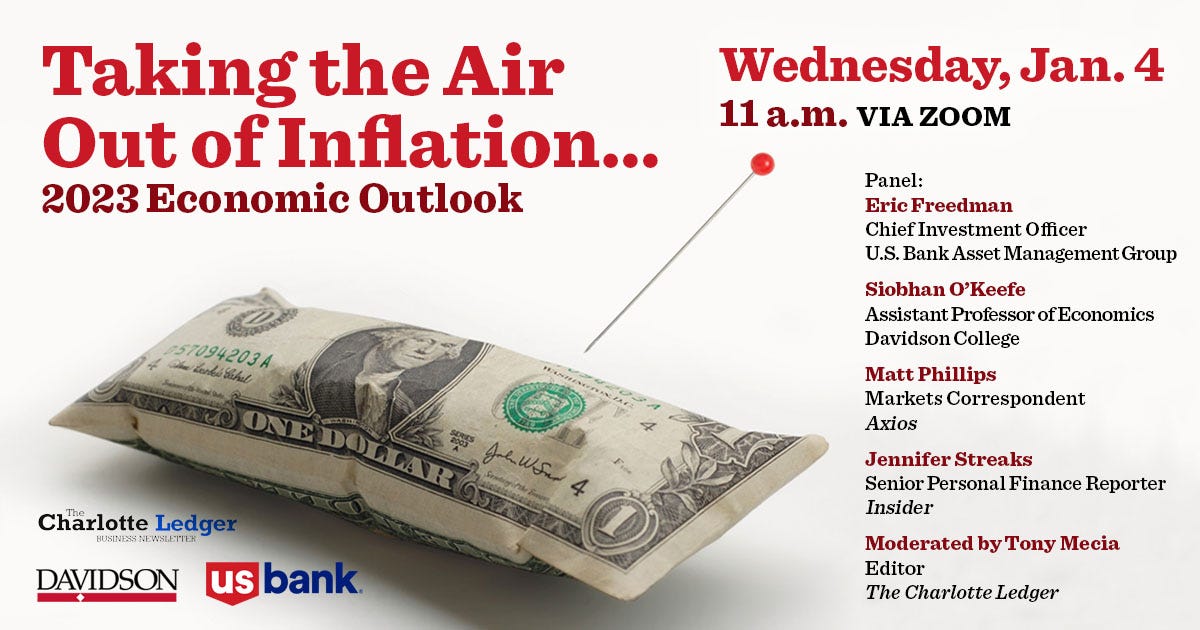

Join us Jan. 4 for a Zoom panel on 2023’s economic outlook

Mark your calendar! Get the scoop on what lies ahead for the U.S. economy.

The Ledger is teaming up with U.S. Bank and Davidson College for an online panel on the economy on Wednesday, Jan. 4, at 11 a.m. Panelists are a Davidson economics professor, the chief investment officer of U.S. Bank’s asset management division and economics correspondents from Axios (national) and Insider. The Ledger’s Tony Mecia is the moderator.

➡️ Details and registration here.

November’s rezoning petitions 🔥: From a new Chipotle to plans for a big business park, we’ve got ’em

What are developers planning? A lot of people want to know, and each month, more than a dozen developers show their cards by filing rezoning petitions with the city.

Sometimes they are big plans — like transforming 46 acres near “LoSo” into a mixed-use development. Sometimes, they are smaller — like building a Chipotle near Park Road Shopping Center.

Either way, each month, we compile all the rezoning filings from the previous month. You can judge whether they’re important to you. (We clue readers in on the more buzz-worthy ones as they come in — our readers have already heard of a few of them from us, like the “LoSo” development and the Chipotle.)

Our rezoning summaries are often imitated, never duplicated.

We make them available to our community of paying subscribers (🔒).

Got some downtime over the holidays? Nourish your brain with The Charlotte Ledger Podcast, or with book recommendations

Traveling over the holidays? Have time in the car or on a plane?

If you ever listen to podcasts, you might consider putting our new Charlotte Ledger Podcast in your rotation.

We’ve recorded 10 mostly timeless episodes — interviews with Charlotte movers and shakers — on a wide range of local topics, including commercial development (apartments, office) , CMS school assignment, the Catawba River’s water quality, Charlotte FC, Charlotte’s tech sector and more. And we have more great ones on the way.

🎧 How to listen: The Charlotte Ledger Podcast is available on our website, as well as on podcast platforms including Apple Podcasts, Spotify, Overcast and Google Podcasts. Most are under 25 minutes. We release new episodes as they are ready, typically every week or two.

📚 What about books? If you’re looking to pick up a new book this holiday or in the new year, you might check out…

Our list from Saturday of book recommendations from Charlotte leaders, including Mayor Vi Lyles and Atrium Health CEO Gene Woods

A list of recommended books by local authors that we compiled last December (Dec. 11, 2021)

Correction

A brief in Monday’s newsletter about complaints over late-night street racing on a stretch of Ardrey Kell Road incorrectly stated that that stretch of road is in Matthews. It is in Charlotte. Apologies.

In brief:

Search for missing girl continues: Police searched part of Lake Norman on Monday for 11-year-old Madalina Cojocari, who was last seen Nov. 23 but wasn’t reported missing until Dec. 14. Her mother and stepfather have been arrested on a charge of failure to report the disappearance of a child to law enforcement. “As part of the normal investigative process, we are expanding our search to include Lake Cornelius as a precautionary measure. There’s nothing we won’t do to #findMadalina,” the Cornelius police department posted on Facebook on Monday. The lake is 2 miles from the girl’s home. (Observer)

Good Friends raises $650,000: The women’s nonprofit organization Good Friends Charlotte raised more than $650,000 at its 36th annual “Gather and Give” luncheon last Thursday. The money raised will be distributed among more than 80 community partners to help local residents in need.

Longtime uptown lunch spot for sale: The owners of Green’s Lunch, which has been operating on 4th Street since 1926, have put their building up for sale for $3M. The building was listed for sale last year but did not sell. (Jason Thomas on Instagram, Axios Charlotte)

Tunnel idea abandoned: Charlotte transportation and planning officials along with the mayors of Davidson, Huntersville and Cornelius met with officials from Elon Musk’s The Boring Co. last year to discuss the possibility of a tunnel linking Charlotte and the towns, but nothing came of the meeting. (Axios Charlotte)

Fewer flights at CLT: The number of daily departures from Charlotte’s airport is down 21% since December 2019, at 555 a day this month, but the number of passengers is expected to be similar because American Airlines has replaced smaller regional jets with larger aircraft. (Forbes)

$10M gift: The C.D. Spangler Foundation is giving $10M to Atrium Health’s Giving Hope campaign aimed at women’s care. The campaign seeks to increase access to care, expand education and training programs and improve birth outcomes. The gift is from Anna Spangler Nelson and her husband, Thomas Nelson, who is chair of both Atrium’s board of directors and the new Advocate Health board.

Gridlock tickets: Mooresville Police have issued dozens of citations to cars blocking an N.C. 150 intersection while attempting to turn left at Williamson and Bluefield roads near Lake Norman. Drivers get stuck in the middle of the intersection because of traffic build-up, which is punishable by two driver’s license points and $216 in court costs and a fine. (Observer)

Need to sign up for this e-newsletter? We offer a free version, as well as paid memberships for full access to all 4 of our local newsletters:

➡️ Learn more about The Charlotte Ledger

The Charlotte Ledger is a locally owned media company that delivers smart and essential news through e-newsletters and on a website. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

Like what we are doing? Feel free to forward this along and to tell a friend.

Social media: On Facebook, Instagram, Twitter and LinkedIn.

Sponsorship information/customer service: email support@cltledger.com.

Executive editor: Tony Mecia; Managing editor: Cristina Bolling; Staff writer: Lindsey Banks; Contributing editor: Tim Whitmire, CXN Advisory; Contributing photographer/videographer: Kevin Young, The 5 and 2 Project