Who is creating the most jobs in Charlotte?

Plus: Amelie's might ditch original NoDa location; S.C. tech start-up identifies haunted houses; US Airways returns $15 bag fee after 9 years

Good morning! Today is Monday, June 3, 2019. Need to subscribe? Sign up for free here (charlotteledger.substack.com).

In focus: Charlotte’s job growth since the recession

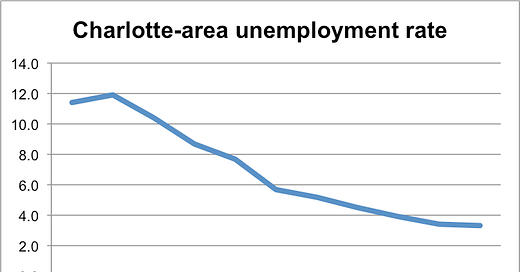

The unemployment rate in the Charlotte region fell to 3.3% in April, the Labor Department reported last week. That’s astoundingly low and means that pretty much everybody who wants a job here has one.

In the aftermath of the last recession a decade ago, the area’s unemployment hit around 12%. It has dropped gradually. The bigger problem now is employers being unable to find workers.

After the recession, the Charlotte area’s unemployment rate dropped geeennttlllyyy, to 3.3% in April. (Source: Bureau of Labor Statistics)

With local unemployment low and the recession a decade behind us, it’s an appropriate time to check in and see where all these jobs have come from.

According to the Labor Department, the Charlotte region in the last 10 years has added 267,000 jobs, to a total of more than 1.2 million in April. The number of jobs has grown by about 28% since 2009 — a pace that other cities would kill for. Hmm, who can we pick on here? In the same time, the number of jobs in Buffalo rose 6%. In Detroit, 8%. Charlotte’s job growth is even faster than Atlanta’s (on a percentage basis). It clocked in at 21%.

But where are the jobs coming from? Let’s look at the numbers:

Professional and business services far outpaced other sectors in job creation in the last decade. (Source: Bureau of Labor Statistics).

Leading the way, overwhelmingly, was professional and business services — a broad category that encompasses a range of services that businesses provide to other businesses, including legal work, accounting, clerical tasks, waste hauling and many others.

It was followed by trade/transportation/utilities, then by leisure/hospitality, which includes employment at Charlotte’s growing number of hotels, restaurants and bars. Those beers don’t pour themselves. (Actually, some of them do pour themselves.)

You look at the chart, and it’s a good mix, probably weighted toward office jobs and not as much toward, say, construction jobs. As nice as it is to land all these corporate headquarters and bank expansions, it is important for our economy to have a mix and not become too reliant on any one sector. We need tech workers and manufacturing companies and medical research and construction. Not everybody is cut out for a standard-issue office job.

When the next recession comes — and it will come — Charlotte will benefit from having a balanced economy.

Is Amelie’s preparing to leave its flagship NoDa location?

A legal dispute between owners of a strip mall in Charlotte’s NoDa neighborhood could be pushing Amelie’s out of its original site.

Court documents show that the lease of the popular French bakery was to have expired in March and that landlords disagreed about negotiating an extension. Common sense also dictates that a spot in a largely vacant and dilapidated strip shopping center that is increasingly surrounded by breweries and luxury apartments might be prime for redevelopment.

Efforts to reach Amelie’s owners over the weekend were unsuccessful. But an employee working the register told me Saturday morning: “We’re not closing, but we are going to be moving in about a year. They’re being vague about it.”

Contradictory signals, threats to leave: Owners of the Amelie’s property are locked in a legal dispute over who has the authority to run the company and negotiate leases. Court documents show that Amelie’s managing partner, Frank Reed, wrote an email to landlords in 2017 expressing frustration at receiving conflicting information and asking who was in charge. He also expressed alarm at the landlord’s plans to redevelop part of the property in a way that would leave Amelie’s intact but provide inadequate parking for Amelie’s customers: “I notified the Landlord that this was not negotiable and if not resolved, then Amelie’s will not renew our lease and will relocate at the end of our term.”

Court documents show Amelie’s lease was to expire March 15, 2019, and it’s unclear if the two sides negotiated an extension. In the year before that, Amelie’s was scheduled to pay $7,855 a month for nearly 5,900 square feet, or $16/square foot — about half of what rents are going for uptown. The lease of the vape shop in the same shopping center was scheduled to expire in November 2019. The only other business in the center appears to be a small boutique. A half-dozen other storefronts are empty.

Tax records show the value of the strip center rose from $2.8M to $11.5M in the county’s recent revaluation. It is owned by 28th RO Commercial of Naples, Fla., which is a company formed by the Mizzi family of Toronto, Canada; Max Mazzone of Florida; and Charlotte real estate investor Chris Needham.

Relationships among the owners fractured over a dispute involving distribution of the money from the 2016 sale of condos in Plaza-Midwood, court documents say.

One of the landlords described Amelie’s in court documents as “something of a Charlotte institution” that “serves as a neighborhood foodie hotspot and high-end coffee establishment. … Not every commercial tenant is cut out to thrive in the ‘edgy’ southern part of the NoDa neighborhood. But Amelie’s Bakery is well suited for that area.”

Amelie’s opened in NoDa in 2008. It also has locations at Park Road Shopping Center, uptown, Carmel Commons, Rock Hill and Atlanta. In 2015, it was named one of the most Instagrammed bakeries in America, and it appeared on BuzzFeed’s list of “23 Bakeries Around The World You Need To Eat At Before You Die.”

Tweet of the day: No spelling trophy for WCNC

Do you “agre”?

Morbid South Carolina tech start-up:

How’s this for an off-the-wall business start-up? From an article last week from The Hustle about an entrepreneur outside of Columbia, S.C.:

Back in 2013, software developer and part-time landlord Roy Condrey got a text from a tenant in the middle of the night: One of his rental properties, the tenant claimed, was haunted.

When he looked into the matter, Condrey discovered that the property’s previous owner had, in fact, died in the home. Moreover, he found that in many states, real estate agents aren’t legally required to disclose a death or any other event that doesn’t impact the physical structure of the property. …

Sensing a market opportunity, Condrey launched Diedinhouse.com, a site which, for $11.99 per search, scrapes over 118 million private and public records to tell you if (and even how) someone died in your home.

Without any marketing or paid advertising, Diedinhouse.com now gets thousands of organic hits a day via popular queries like “how to know if someone died in your house.” The site’s business model relies on a mixture of morbid curiosity and practical inquisitiveness.

“People talk a big game,” says Condrey, in his warm Carolina twang, “but when push comes to shove, they’re not going to buy a house where someone has been murdered.”

Truth.

Reader response

Ledger readers respond to recent articles:

On the report that Charlotte Agenda termed Steele Creek the “next hot neighborhood”:

“I’m all for Charlotte boosterism, but I’ll be deep in the cold, cold ground before Steele Creek can be meaningfully described as a ‘hot’ neighborhood. It is an urban wasteland, and no amount of mid-tier stick-built apartments will change that.”

On the link to an article saying that millennials are approaching middle age in poor financial shape:

“Millennials are approaching middle age? Holy cow, I must be elderly.”

On the news that Lowe’s is considering Charlotte and Dallas for a 2,000-worker tech hub:

“So Lowe’s is going to hire 2,000 engineers to build another generation of custom software, which won’t keep pace with the industry and can take the blame for an earnings shortfall in five years when it too becomes outdated? Genius. Maybe they should implement some cloud software and focus on selling home improvement products, which they do very well.”

On Wednesday’s article examining trends in Charlotte office space:

“Liked the story about companies being pickier about their office space and wanting flair. The place next to us just renovated and added beanbags and a putting area to their foyer. Whiny millennials need fun stuff to enhance their boring jobs.”

On Wednesday’s article about the allegations of broken air conditioning and overcrowding at a Music Factory nightclub:

“Tons of people smoking joints and blowing coke all night ... sounds like a typical night at my house.”

On Friday’s article about Charlotte-area FCC complaints about obscenity and profanity:

“I hate John Boy & Billy. And I should know, because I’ve been listening to them for 30 years!”

“Never was a fan of John Boy & Billy!”

“I don’t understand the people who complain about breasts showing on the weather. I need to start watching TV weather.”

Have an opinion? Share it here.

In brief:

Deal or no deal: Some county commissioners want to reopen a 2016 agreement the county made to sell part of Marshall Park to a developer, who plans to build apartments, condos, office space and retail. (Observer)

UNC Charlotte economist predicts 2.5% NC growth in 2019: John Connaughton said, “We are growing, but we are not doing what we used to do. We have recovered, but we haven’t grown above the average of the U.S. If you are in the major cities of North Carolina, the economy appears to be in good shape. Everywhere else in the state, it has been a different story economically as recovery continues.” (Charlotte Stories)

Smoothie King fires 2 for racist language: The chain has terminated two Charlotte employees at different locations who entered offensive language instead of customer names on receipts. One entered a customer’s name as the n-word and the other printed an Asian customer’s name as “Jackie Chan.” (QCityMetro)

Putting the “park” in SouthPark: The city and mall owner Simon Property plan to pump $10M into Symphony Park behind SouthPark mall and add children’s play areas, public art and walking and biking trails. (Agenda)

Cool data: Ely Portillo of UNC Charlotte’s Urban Institute wrote a column last week calling attention to a fascinating local data source called the Quality of Life Explorer. You can see maps of education level, average age of death, household income and dozens of other measures. South Charlotte tends to stand out from the rest of the city in much of the data.

Economic mobility: WFAE’s Steve Harrison asks an intriguing question in his most recent weekly newsletter about that 2014 economic mobility study: Now, five years later, is Charlotte still ranked last? Turns out nobody knows. “With no real data coming for decades, there will be few (definitive?) answers.”

Checkmate: Charlotte’s two largest chess-teaching companies, the Charlotte Chess Center and Young Master Chess, have merged, they announced Saturday.

Airline refunds fees … after nine years: Settlement checks have gone out to about 400,000 old US Airways customers who experienced baggage delays. A Ledger reader reports he received a check for $18, following a class-action settlement. The payout stems from a 2010 case, Hickcox-Huffman v. US Airways, in which a woman traveling to San Luis Obispo, Calif., paid a baggage fee of $15 but her bag arrived a day late — and US Airways refused to refund her fee. You can tell it’s an old case because the baggage charge was only $15.

Taking stock

Unless you are a day trader, checking your stocks daily is unhealthy. So how about weekly? How local stocks of note fared last week (through Friday’s close), and year to date:

Stock indexes fell again last week. That’s six straight weeks of drops for the Dow Jones Industrial Average, the longest losing streak since 2011. Rough May.

And if the Federal Reserve lowers interest rates, that could hit bank stocks, according to The Street:

Bank of America could see its earnings per share hit the hardest by Federal Reserve stimulus, analysts at Morgan Stanley wrote in a note. …

With the economy clearly slowing — JPMorgan economists say they see U.S. second-quarter 2019 GDP slowing to just 1% — the Federal Reserve is far more likely than previously to cut interest rates in 2020.

Bank of America would see EPS fall by about 2% from current expectations, Morgan Stanley analysts said. BB&T could see a 1% EPS ding from stimulus, which is the second-hardest hit out of the 17 banks in Morgan Stanley's analyst coverage. JPMorgan and Citigroup could both see 0.6% to 0.7% hits to EPS.

Got a news tip? Think we missed something? Drop me a line at editor@cltledger.com and let me know.

Like what we are doing? Feel free to forward this along and to tell a friend.

The Charlotte Ledger is an e-newsletter and web site publishing timely, informative, and interesting local business news and analysis Mondays, Wednesdays, and Fridays, except holidays and as noted. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

The Charlotte Ledger is published by Tony Mecia, an award-winning former Charlotte Observer business reporter and editor. He lives in Charlotte with his wife and three children.