Home sale prices fall in some local counties

Plus: Can you tell the difference between an AI chatbot and corporate PR?; Sizzling-hot details on last month's rezonings; Push to help uptown's older office buildings; Drone nabs rock-throwing teens

Good morning! Today is Monday, February 27, 2023. You’re reading The Charlotte Ledger, an e-newsletter with local business-y news and insights for Charlotte, N.C.

Need to subscribe — or upgrade your Ledger e-newsletter subscription? Details here.

Today's Charlotte Ledger is sponsored by Fox Rothschild, a national law firm whose Charlotte-based attorneys provide litigation, real estate, labor and employment, corporate and a wide range of other services to clients in the Carolinas and across the country.

Rural areas encounter rare dips in prices as mortgage rates rise; Realtors ‘get creative’ to close deals and resurrect the ‘2-1 buydown’

by Tony Mecia

After years of a strong real estate market that led housing costs to surge, some counties in the Charlotte region are encountering a rarity: falling home sale prices.

Higher-than-usual interest rates have slowed the demand for housing around the country, including in the Charlotte area. That has resulted locally in prices, on average, rising more slowly than they did in 2021 and early 2022, which real estate agents have characterized as the market “normalizing.”

But in the last few months in several local counties, the median sales prices of houses are lower than they were a year ago. And in some cases, agents say they’re having to get creative to seal the deals, with sellers offering incentives — an abrupt reversal from just a couple years ago, when buyers were the ones with less leverage in the process.

“You can’t be a one-trick pony — you’ve got to get creative,” says Jamie Young, the managing broker with Sellstate Executive Real Estate, who works in Lincoln and Cleveland counties, where sales prices have recently dropped. “There are things that everyone can do to help the consumer and educate the consumer. They think they can’t buy, but they really can. You just have to educate them on different options available to them.”

In Lincoln County in January, the median sale price of a house was a little more than $394,000, 6% less than the $418,000 a year earlier, according to data from Canopy Realtor Association. It was the third straight month of year-over-year declines. Sales prices in Cleveland County, west of Charlotte and home to Shelby, were down 9% and have also been in negative territory for three months in a row.

Median sales prices also fell in Anson and Montgomery counties in January, and in the towns of Denver, Gastonia, Monroe and Waxhaw, according to Canopy numbers — although small numbers of closings in smaller communities can make the numbers volatile. (In Anson, for instance, there were just seven sales in January.)

Overall in the Charlotte region in January, prices were up 7%.

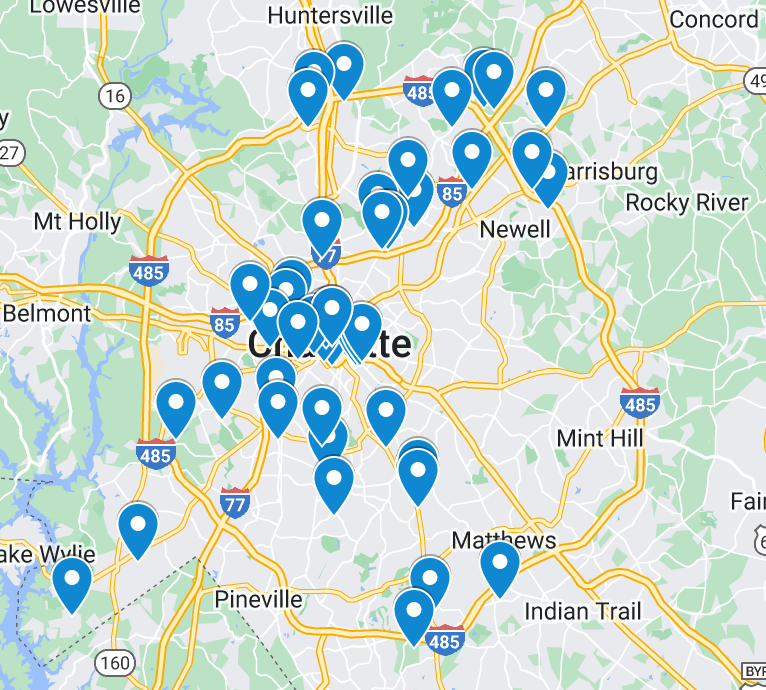

Median sales prices in Lincoln and Cleveland counties have fallen year-over-year for the last three months, as higher interest rates drive buyers out of the market. In other Charlotte-area counties, prices are still increasing, just not as fast as previously, .

Return of the buydown: Young said he is seeing more sellers offer what’s called a “2-1 buydown,” an arrangement in which the seller offers to rebate a portion of the sales price — typically around $5,000 to $10,000, Young said — to lower the buyer’s interest rate for the first two years. At the end of the two years, the rate reverts to the usual fixed rate — at which time the buyer can either refinance to a lower rate or is perhaps making more money and can afford the higher interest payment.

The Wall Street Journal reported in December that buydowns, which had fallen out of favor since the 2008 financial crisis, are “making a comeback.” Homebuilders also offer them routinely.

Young says higher interest rates are hitting largely rural Lincoln and Cleveland counties more severely than the more urban areas of the Charlotte region. When rates went up last year, “they knocked a lot of buyers out of the market,” he says.

Rates on a 30-year fixed mortgage are around 6%-7%, the highest in about 15 years, and about double what they were in early 2022. The Federal Reserve is expected to increase interest rates over the next few months, and perhaps longer, depending on what happens with inflation.

Could it happen in Charlotte? It’s unclear if sales price declines will eventually migrate to Charlotte, too. Mecklenburg County, like most counties in the Charlotte region, had year-over-year price increases in the 20% range in the first half of 2022. Now, most counties are in the positive single-digits, with Mecklenburg’s prices rising 8.5% in January, compared with a year earlier, according to Canopy data.

Yongqiang Chu, director of UNC Charlotte’s Childress Klein Center for Real Estate told The Ledger last month that it’s hard to foresee prices in Charlotte falling significantly because demand is so great.

Related Ledger article:

“A property revaluation at the housing market’s peak?” (🔒, Jan. 13)

You make the call: authentic corporate PR response, or an AI chatbot?

We wrote Friday that it appears that Starbucks might be pulling out of shopping malls, as its stores at SouthPark Mall and Carolina Place Mall have closed.

But we didn’t hear back from Starbucks by press time.

On Saturday, though, we did receive a reply from a Starbucks spokesman via email. It didn’t answer our question — at all — which noted that Starbucks had closed stores at a few malls in Charlotte and asked: “Is that part of a broader strategy away from traditional shopping malls?”

So we wondered: Could an AI chatbot do better?

Here are the two replies. One is the email reply from the Starbucks spokesman. The other was generated by ChatGPT in response to our command to craft a reply from a public relations professional to the question we sent Starbucks (which we included for ChapGPT to consider).

We’re not telling you which is which. See if you can figure out which is the real PR response and which is the fake one!

Response 1:

Thank you for your inquiry regarding recent store closures at shopping malls in Charlotte. As a company, Starbucks regularly evaluates our store locations to ensure we are meeting the needs of our customers and providing the best possible experience.

While we cannot speak to specific store closures at this time, we want to assure our customers and partners that our commitment to providing high-quality coffee and exceptional service remains unchanged.

As part of our ongoing strategy, we are constantly evaluating the performance of our stores and making decisions that will allow us to best serve our customers. This includes opening new stores in areas with high demand and optimizing our existing store portfolio to align with customer needs.

Response 2:

As a standard practice, we continually evaluate our store portfolio to ensure it’s meeting the needs of our customers and the communities we serve. Throughout the process, we listen to our partners to ensure we’re making the best decision for them, the community and our company. We look forward to continuing to serve the community at our other Charlotte locations, and customers can use the Store Locator on the Starbucks app or website to stay up to date on their store’s hours of operation.

(Eerie how they both mention “store portfolio,” right, even though that term was not in the question?)

Can you identify the fake response — the one from ChatGPT? Take this poll, or leave your theories in the comments (paying members only), and we’ll tell you how discerning our readers are later this week.

Related Ledger article:

“A computer wrote this entire newsletter. How did it do?” (June 7, 2021)

January was an epic month for developers announcing plans; we’ve got all the sizzling details

Charlotte rezoning filings are always hot 🔥, but last month’s were face-of-the-sun scorching 🔥🔥🔥.

As we wrote on Feb. 1, many developers raced to meet a Jan. 31 deadline to have their plans considered under existing zoning rules, before the new Unified Development Ordinance takes effect. The result: 47 rezoning filings, when the city considers just 16 a month.

We’ve been cataloging and sharing monthly rezoning filings for more than three years — because they provide an early look into what will be built around us — and we can’t recall any month in which the rezoning action came this hot and heavy.

Elizabeth, west Charlotte, Providence Road, Park Road Shopping Center area, Mallard Creek, Ballantyne, University City, Dilworth, Rea Farms, SouthPark … all of them have sites where developers threw caution to the wind and laid bare their plans to build something:

As we do every month, we lay out the details in all their glory, so residents and real estate pros can take a close look before the petitions start winding through the city’s process, which can take many months.

Our monthly rezoning reports, though, are available only to our community of paying members (🔒). If you’re a member, check it out … if you think you can handle it:

Related Ledger articles:

“1,500 new homes + grocery store planned for Providence Road corridor” (Jan. 31)

“Plans announced for 2,400 south Charlotte homes + new middle school” (🔒, Feb. 1)

“Plans revealed for new CMS middle school alongside new massive housing development in south Charlotte” (🔒, Feb. 3)

You might be interested in these Charlotte events

Events submitted by readers to The Ledger’s events board:

THROUGH TUESDAY: Nominations for the 2023 Sustain Charlotte Awards. Deadline Tuesday, awards ceremony April 27. Nominations for the 2023 Sustain Charlotte Awards are open through Feb. 28th! Do you know a person or organization who deserves to be honored for advancing sustainability in Charlotte? Nominate them today at sustaincharlotte.org/awards!

◼️ Check out the full Ledger events board.

➡️ List your event on the Ledger events board.

Correction

An article in some editions of Friday’s newsletter misstated the date that one of the airport’s security checkpoints, Checkpoint B, will close. It will close March 17. (Not in May.) Our apologies.

In brief:

Push to help older uptown office buildings: Charlotte Center City Partners says it is in the beginning stages of an effort to push for renovations or adaptations of older uptown office buildings. Buildings constructed before 1990, which account for 41% of uptown’s office space, have a vacancy rate of 23%, or nearly triple the rate of newer office buildings, according to CoStar data. The Ledger reported last week that two 1980s-era uptown office buildings on College Street appear to be in financial trouble after losing tenants. (Biz Journal, subscriber-only)

Business leader drug charges: Art Gallagher, the former president of Johnson & Wales’ Charlotte campus, was arrested this month and charged with possessing methamphetamine and drug paraphernalia in Gaston County, according to police records. Gallagher, 71, resigned this month as interim executive director of the Daniel Stowe Botanical Garden. He is also formerly a vice president at the Novant Health Foundation. (Observer)

Wells Fargo layoffs: Wells Fargo laid off hundreds of mortgage bankers last week, as interest rates are at historically high levels and the bank has shifted focus away from mortgages. (CNBC)

Street closure hits restaurants: Some restaurants in Plaza-Midwood say the closure of Central Avenue to replace wastewater pipes is hurting their businesses. Bistro La Bon says it gets 30-40 diners instead of the usual 100, and Moo & Brew says business is down 30%. Charlotte Water says the road will remain closed through mid-March. (WFAE)

Uptown street racing: Some uptown residents say they’re concerned about persistent middle-of-the-night street racing. “Literally, at 2 in the morning, all you hear is street cars just racing and doing burnouts, and as soon as you open your balcony door, all you smell is the smoke,” one resident said. Another witness said: “Guys are doing 360s, donuts. Guys are dodging out of the way — looked like somebody was about to get hit, but nobody did, luckily.” (WSOC)

Rock-throwing teens identified by drone: The Union County sheriff’s office used a drone Friday night to find 5 teens believed to have been throwing rocks at cars from a bridge over the Monroe Expressway. The teens are expected to face criminal charges. (WSOC)

Taking stock

Unless you are a day trader, checking your stocks daily is unhealthy. So how about weekly? How local stocks of note fared last week (through Friday’s close), and year to date:

Need to sign up for this e-newsletter? We offer a free version, as well as paid memberships for full access to all 4 of our local newsletters:

➡️ Learn more about The Charlotte Ledger

The Charlotte Ledger is a locally owned media company that delivers smart and essential news through e-newsletters and on a website. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

Like what we are doing? Feel free to forward this along and to tell a friend.

Sponsorship information/customer service: email support@cltledger.com.

Executive editor: Tony Mecia; Managing editor: Cristina Bolling; Staff writer: Lindsey Banks; Contributing editor: Tim Whitmire, CXN Advisory; Contributing photographer/videographer: Kevin Young, The 5 and 2 Project