The 4 factors that fueled Charlotte’s decade of resurgence

Plus: Humongous warehouse proposed for River District area; Construction starts on Mama Ricotta's sister restaurant in SouthPark; American sues Delta for poaching the word 'flagship'

Good morning! Today is Monday, December 30, 2019.

Need to subscribe? Sign up for free here (charlotteledger.substack.com). Like what you see? Forward to a friend.

Programming note: The Ledger will return on Jan. 6, 2020. Happy New Year.

Guest column: Investments in light rail and other big projects paved the way for a development boom that’s powering us into the 2020s; ‘vision, commitment and foresight’

By CLT Development

At the beginning of 2010, times were dark. Our ego was shattered. We thought our time as “the new New South city” might be over.

Charlotte was reeling from a global recession, a year after losing Wachovia — a bank whose home had been in North Carolina for 130 years — to San Francisco. Duke Energy Center, originally imagined for Wachovia, was near completion, a reminder of the good times of the aughts.

Vue Charlotte, the 51-floor residential tower on 5th and Pine streets — today thought of as a successful luxury apartment tower — was largely dark, with only 16 of 409 condo units closing in the end. Eventually, it was sold on auction to Northwood Ravin and converted to apartments.

Charlotte comeback: In the decade of the 2010s, though, Charlotte found its way back. We kept landing corporate headquarters, added jobs and continued drawing people: The city’s population grew by more than 140,000 residents in the decade, a surge of 20%. Now, those tough days of 10 years ago seem to be in the distant past, with cranes and orange construction barrels all over the city.

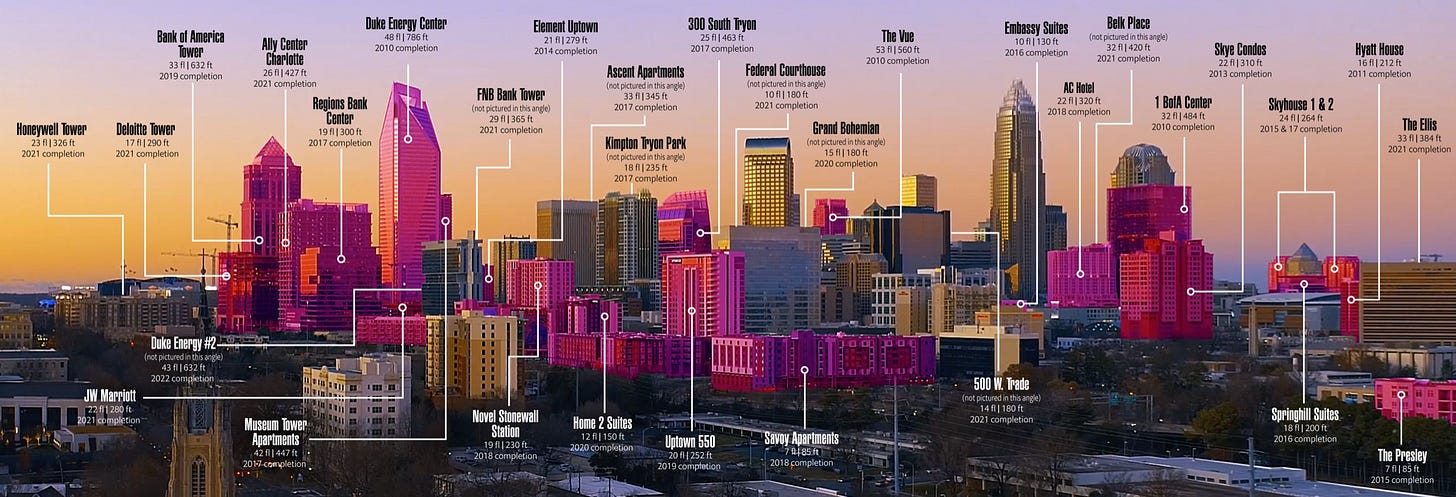

Pretty in pink: There were 30 buildings of 12 stories or higher completed or that started construction in the 2010s in uptown Charlotte. (Photo illustration by Clayton Sealey/CLT Development)

Four major events have contributed to Charlotte’s comeback in the commercial real estate industry, as well as on the national stage:

1. Ace in our pocket

In 2007, when the economy started to flounder, the city was busy opening the doors to a new opportunity, the Lynx Blue Line. Early on, to the surprise of naysayers, ridership far exceeded expectations, and suddenly, there was regional and national interest in South End. This kept the commercial real estate industry, coming down from the high of the previous cycle, busy building mid-rise apartments all along the Blue Line.

When there’s a recession, the first (development) impacted is the more intense developments — it gets hard to get financing for a 20-story, mixed-use project. So developers are moving to rental. From a land-use perspective, we are OK with that. What matters to us is the density, not the ownership.

— Debra Campbell, director of the Charlotte-Mecklenburg Planning Commission, to the Charlotte Business Journal in April 2011.

Since its opening in 2007, the original Blue Line has led to more than $2B in investment in South End and points south, including 2 million s.f. of commercial space and nearly 10,000 residential units. Today, South End has become one of the fastest growing submarkets in the Southeast, as well as an attractive landing place for companies both local and regional.

2. An interchange transformed

In 2009, the city wrapped up work on another great investment, the reimagining of the I-277 interchange at Caldwell and Stonewall streets. The two-year project reorganized and urbanized the 31-acre suburban-style interstate interchange and opened up an additional 12 acres of land for redevelopment. The recession slowed the development of the area at first, but once things started to pick up, it flourished.

This investment opened up Stonewall Street to high-density development, leading to the newest “main street” uptown. Today, what was vastly underutilized land now sports thousands of new residents and workers, uptown’s first full-sized grocery store and more than $1B in investment along Stonewall.

When originally sourced and conceived in 2014, the Stonewall Station investment represented the largest and most complex development Crescent Communities had ever embarked on. It took an unwavering vision, commitment and foresight into the potential for Uptown’s ‘financial district’ to transform into Charlotte’s most sought after residential destination, to influence Whole Foods Market to open the first full size grocery store in Uptown and partners like JP Morgan and Asana Partners to all make significant investments in this extremely bold development program.

— Michael Tubridy, managing director at Crescent Communities, in a statement.

Thanks to the growth along Stonewall and the Blue Line, Charlotte's commercial district has moved Southwest, bleeding into South End, where today you can find high density commercial and residential development popping up all over.

3. Third Ward

It's amazing what you can create when you set aside land for public green space. There was no better example in the last decade than the neighborhood that has flourished uptown in Third Ward.

Anchored by the 5.6-acre Romare Bearden Park, which opened in 2013, Third Ward has grown from a vast expanse of parking lots to a vibrant area. It now includes a new Kimpton Hotel, numerous residential towers and the home of the AAA baseball Charlotte Knights.

The future of Third Ward is Gateway Station, and the district planned around it. In October, three development firms were shortlisted as finalists to submit proposals for the area dubbed “The Station District.” Its future will determine what the next decade is like for Third Ward and much of uptown.

4. The strength of the ’burbs

The past decade has been as much about the densification of the suburbs as it has been the center city. All along the I-485 corridor, denser communities are popping up. Around Providence Road and I-485, new urbanism communities like Waverly and Rea Farms have emerged, replacing farmland and public golf courses with “Live Work Play” options for folks pushed out of the center city by high prices.

In 2017, Charlotte’s most successful master planned community, the 535-acre Ballantyne Corporate Park, was sold for a staggering $1.2B. The sale, to Northwood Investors, included 4 million s.f. of office, four hotels, and the Ballantyne Golf Club. This year, Northwood released plans to transform the golf club into a dense 25-acre town center, complete with a high-rise residential component, shopping, restaurants and park land.

It’s not just south Charlotte. Similar communities have begun popping up in nearly every corner of the city, from the River District, to Prosperity Village, to Steele Creek to University City. As Charlotte’s traditional urban neighborhoods price out residents, people are looking toward what had previously been bedroom communities, now ripe for redevelopment.

The future

It remains to be seen what the next decade holds for Charlotte. A lot hangs on the economy and how much longer it can retain its current luster.

One of the common threads of the last decade has been city/county investment, and it’ll be interesting to see what projects we invest in during the next decade. There are numerous public-private partnerships on the horizon, including the redevelopment of the Charlotte Transit Center, the birth of a Gateway Station and the potential to transform three different areas of uptown: Brooklyn Village, 7th and Tryon, and the Hal Marshall center.

Investments in culture, entertainment, and education will be important. We can expect a massive shift by Discovery Place to create a world-class Science Museum uptown and a new Nature Museum in Myers Park. We should also expect to see a new home for the Panthers and the soon-to-be-named Major League Soccer franchise. It’s also important we close the educational gap with the Triangle and foster our institutions for higher learning, establish a medical college and expand UNC Charlotte’s footprint uptown.

There is also our investment in our transit system. In 2018, the Blue Line Extension was rolled out, connecting uptown to UNCC, and along with it a new TOD (Transit Oriented Development) ordinance, which brings many new possibilities for growth along the transit line. How we implement these development guidelines in the future will determine how we build a better, more connected city in the next decade.

CLT Development is a social media account that covers, explains and occasionally critiques commercial development in Charlotte, while fostering and leading discussion about urban planning/transit/city building initiatives. It is managed by Clayton Sealey, with the help of contributors. This week, CLT Development is releasing its 2019 “Crane-y Awards” for Charlotte development. You can follow the action on Twitter and Instagram.

The mother of all Mecklenburg warehouses?

A developer has submitted plans to the city to build up to 1.5 million square feet of warehouse space west of I-485 near the airport — which might not sound too exciting, except that that much warehouse space is about double the size of Mecklenburg County’s largest existing warehouse.

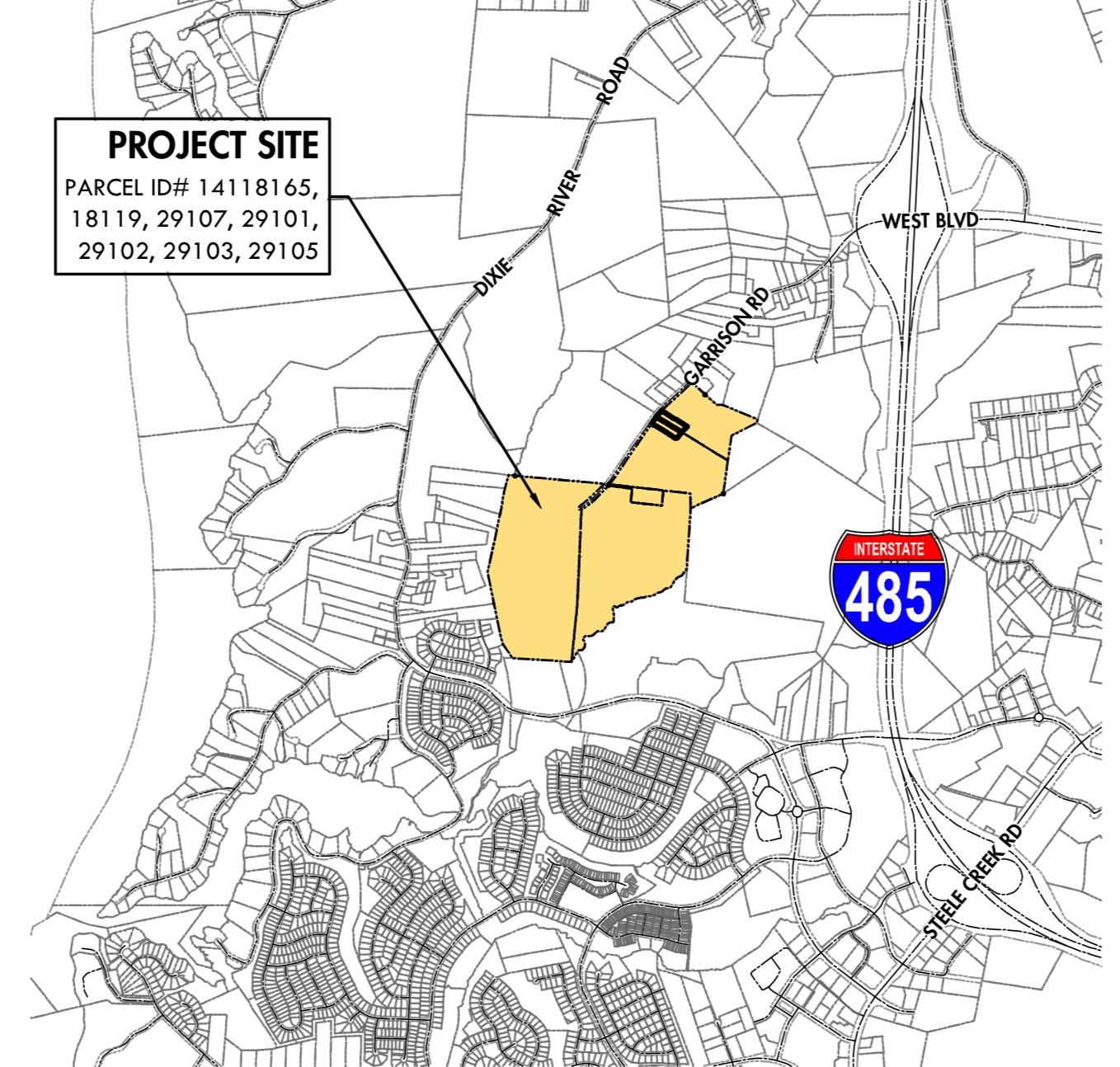

A rezoning petition by warehouse developer McCraney Property Co. asks the city to rezone 153 acres off Garrison Road, between Steele Creek and the River District under development near the Catawba River:

Big honkin’ warehouse: Plans from warehouse developer McCraney Property Co. call for “up to 1,450,000 square feet gross floor area of warehousing, warehouse distribution, manufacturing, office and all other industrial uses” allowed in the zoning.

McCraney’s managing director declined to talk about the project when reached by The Ledger last week.

The largest warehouse in Mecklenburg County is believed to be Amazon’s new fulfillment center in west Charlotte, which is 855,000 s.f. The largest distribution centers in the Charlotte region as of 2017 belonged to Target Corp. in Newton (1.5 million s.f.), Lowe’s Cos. in Statesville (1.47 million) and Black & Decker in Fort Mill (1.37 million), according to the Business Journal’s Book of Lists.

Go deeper: Warehousing and logistics don’t get a lot of attention in the Charlotte region, but it is a fast-growing sector of our economy, thanks largely to the growth of online shopping, The Ledger reported in August.

The warehousing was one of 16 rezoning applications submitted this month. Others included plans for:

Ballantyne townhomes: Up to 164 townhouses behind Community House Middle School in Ballantyne, off Blakeney Heath Road.

SouthPark building: A new six-story office/retail building in SouthPark on Coltsgate Road — across Sharon Road from SouthPark mall.

West Charlotte townhomes: Up to 133 townhomes in west Charlotte between West Trade Street and Rozzelles Ferry Road, on Judson Avenue.

The details are at the end of this newsletter.

In brief:

SouthPark Italian: The owner of Mama Ricotta’s has started construction of a new Italian restaurant in South Park, to be called Little Mama’s. It will be in the Porter Building (formerly known as the Siskey Building), next to Diamonds Direct on Sharon Road at the site of the old Zebra Restaurant, which closed in 2016. It will seat 140 and could be open by March, a spokesman for parent company FS Food Group told The Ledger. The restaurant “is equal parts upscale and casual” and offers Charlotte “its first ever mozzarella bar featuring house-made mozzarella, stracciatella, burrata and bufala mozz, along with rotating chef-inspired accompaniments and a menu driven by Frank Scibelli’s memories of neighborhood establishments growing up.”

Hotel opening: The 162-room AC Hotel Charlotte SouthPark opened on Saturday, on Roxborough Road next to Specialty Shops. It features a “Spanish-inspired wine and tapas bar” with a patio on the ground floor. A rooftop bar and terrace is expected to open in the spring.

Airline ‘flagship’ lawsuit: American Airlines is suing Delta Air Lines over Delta’s use of the term ‘flagship’ to describe premium air-travel services. “Despite knowing that American owns the exclusive right to use the Flagship marks, Delta has begun to use the terms ‘flagship,’ ‘Flagship,’ and ‘FLAGSHIP’ to promote its own airport lounges and premium services and interiors,” American wrote in the complaint, filed in federal court in Texas. (One Mile at a Time)

Pricey offices: Duke Energy agreed to sell its new 40-story office tower on South Tryon Street near Stonewall Street for up to $675M — the most expensive office sale in state history. Buyers are developer Childress Klein and Maryland-based CGA Capital, who will lease the space back to Duke. (Observer)

Taking stock

Unless you are a day trader, checking your stocks daily is unhealthy. So how about weekly? How local stocks of note fared last week (through Friday’s close), and year to date:

It was a strong year for the stock market — the S&P 500 is close to having its best year since 1997.

Locally, you would have more than doubled your money if you had bought shares of Sonic Automotive at the beginning of January (+122% on the year). SPX (+81%), Coke Consolidated (+66%) and Bank of America (+43%) are on track to have the strongest finishes of 2019.

Ledger humbled by Queen City Nerve honor

The Ledger was recognized this month by Queen City Nerve, the publication that’s doing yeoman’s work keeping Charlotte’s alt-weekly vibe alive after the demise of Creative Loafing a year ago. It has feet in the print and digital worlds, and it had some very kind things to say about The Ledger — to which it bestowed the title “Best Newsletter” in its “City Life Critic’s Picks 2019”:

Newsletters are the new media wave, but good ones have been hard to come by, or at least they were before Tony Mecia decided to take on the constant evolving business news of Charlotte and drop it in people’s inboxes. The former Charlotte Observer reporter wasn’t done observing just yet and in February launched the Charlotte Ledger newsletter, in which he reports on breaking local business news while touching on other interests like local media, personalities and even cheap flights if you’ve had enough of this place.

There is nothing to click through to; all of the information is presented for consumption in the newsletter itself with no external links, which makes it that much easier to consume. But the main pleasure of waking up to CLT Ledger comes from Tony’s expertise as a reporter, delivering solid facts on news that Charlotteans find interesting.

Like Queen City Nerve, The Ledger has benefited from the support and encouragement of many people. While our publications are quite different, they share the goal of providing original, honest and intensely local information and perspectives — which makes our city a richer and more fulfilling place to live.

As 2019 ends, thank you to everybody for reading, sharing ideas and helping in many other ways to make The Ledger a success. There’s plenty more in store in 2020. Happy New Year. — Tony Mecia

Latest Charlotte-Mecklenburg rezoning applications

OK, so these won’t interest everybody. But if you love local real estate development, here’s your fix:

2019-170. James Doyle, 0.37 acres at 3100 The Plaza from B-1 to NS. “To develop a restaurant.” Rezoning agent: Legacy Real Estate Advisors.

2019-171. Anthony Kuhn of Flywheel Group. 2.55 acres at 3000 N. Tryon St. from I-2 to TOD-UC. Rezoning agent: Flywheel Group.

2019-172. Sharon Academy Properties. 4.12 acres at 4800 Wedgewood Drive from R-4 to institutional. Rezoning agent: Robinson Bradshaw.

2019-173. McCraney Property Co. 153 acres on 7 parcels at 10731 Garrison Road (1,2,3,4,5,6,7) from R-3 to I-1(CD). “To allow a light industrial development” of “up to 1,450,000 square feet of gross floor area.” Rezoning agent: Robinson Bradshaw.

2019-174. 2901 LLC. 1.123 acres at 2901 Coltsgate Road from O-6(CD) to MUDD-O. “Proposed Areas: Office: 87,000 sf. Retail: 8,500 sf. Height: 6 stories +/- 90’” with “5 story parking structure.” Rezoning agent: Wingate Advisory Group.

2019-175. Weekley Homes. 37.165 acres at 9119 Blakeney Heath Road from R-3 to UR-2(CD). “Construct new residential community” of up to 164 single-family attached units. Rezoning agent: Walter Fields Group.

2019-176. Charlotte-Douglas International Airport. 78.678 acres on 6 parcels at 7407 Steele Creek Road (1,2,3,4,5,6) from R-3 to I-2. Rezoning agent: Charlotte airport.

2019-177. Encore Real Estate. 7 acres at 5150 Old Ridge Road from UR-2(CD) and NS to MUDD-O. “Up to 79 multi-family attached (townhome) residential units and 15,000 square feet of commercial uses.” Rezoning agent: Alexander Ricks.

2019-178. DRB Group. 11.476 acres on 8 parcels at 152 Judson Ave. (1,2,3,4,5,6,7,8) from I-2(CD) to UR-C(CD). “To accommodate the development of single family attached (townhome) dwelling units and potential non-residential uses.” Site plan shows maximum of 133 units in buildings up to 60 feet high. Could include 12,000 s.f. of commercial development in lieu of 28 units. Rezoning agent: Robinson Bradshaw.

2019-179. Verde Homes. 1 acre at 1428 Parkwood Ave. from R-5 and R-22MF to UR-2(CD). “To establish a residential development that provides a mix of single family detached units and a multi-family residential building.” Site plan shows 12 units of multifamily in building of up to 50 feet high, plus 8 single family houses. Rezoning agent: Urban Design Partners.

2019-180. Rosegate Holdings. 5.2 acres on 2 parcels at 7406 Wallace Road (1,2) from R-3 to UR-2(CD). “Residential multi-family project.” Site plan shows up to 114 units in three-story residential buildings. Rezoning agent: Urban Design Partners.

2019-181. Woda Cooper Development. 6.54 acres at intersection of Northlake Center Parkway and Northlake Mall Drive from R-3 to UR-2(CD). “To allow development of the site with a multi-family residential community.” Site plan shows up to 78 units. Rezoning agent: Moore & Van Allen.

2019-182. Carolina Center for Recovery. 23.602 acres at 7349 Statesville Road from I-1 to institutional. Rezoning agent: Wingate Advisory Group.

2019-183. Rhyno Partners Coffee. 0.241 acres at 1217 The Plaza from B-2 PED to B-2 PED-O. “To allow development of the site with EDEE uses and a reduction in the required parking.” Site plan shows expansion of existing building, which is the old Sushi Guru in Plaza-Midwood. Rezoning agent: Moore & Van Allen.

2019-184. Taft Mills Group. 4.2 acres on N.C. 24 near Forest Drive from R-3 to R-17MF(CD). “To allow development of the Site with an age-restricted residential community.” Site plan shows up to 72 units in one building. Rezoning agent: Moore & Van Allen.

2019-185. Freedom Communities. 1.67 acres at 3501 Tuckaseegee Road from R-5 to UR-2(CD). Site of Oneway Baptist Church. “Petitioner proposes renovating the existing community building to allow for use as a Child care Center and related Business and Office uses.” Rezoning agent: Johnston Allison & Hord.

Need to sign up for this e-newsletter? Here you go:

Got a news tip? Think we missed something? Drop me a line at editor@cltledger.com and let me know.

Like what we are doing? Feel free to forward this along and to tell a friend.

Archives available at https://charlotteledger.substack.com/archive.

On Twitter: @cltledger

The Charlotte Ledger is an e-newsletter and web site publishing timely, informative, and interesting local business news and analysis Mondays, Wednesdays, and Fridays, except holidays and as noted. We strive for fairness and accuracy and will correct all known errors. The content reflects the independent editorial judgment of The Charlotte Ledger. Any advertising, paid marketing, or sponsored content will be clearly labeled.

The Charlotte Ledger is published by Tony Mecia, an award-winning former Charlotte Observer business reporter and editor. He lives in Charlotte with his wife and three children.